How cryptocurrencies are disrupting Nation-States, part 2 of 2

Why wasn't Satoshi Nakamoto prosecuted? And DAOs and other pleasantries...

Note : this article is the 6th in a series on the disruption of nation-states by the Internet.

Here are the fourteen articles in the series:

How the Internet makes Governments Impotent to Tackle Bottlenecks

How cryptocurrencies are disrupting Nation-States, part 1 of 2

How cryptocurrencies are disrupting Nation-States, part 2 of 2

Digital Shadows: How the Internet Empowers Anonymity and Challenges Governments

How the Internet prevents governments from enforcing their laws

Where it hurts most: how the Internet makes it harder for governments to collect taxes

The Web of Fraud: How the Internet Exposes Nation-States' Weaknesses

In the previous article, we saw why Bitcoin succeeded while E-Gold and Liberty Reserve were crushed by the government. If you haven't read it, I recommend starting with it first, even if it's not compulsory.

In this article, we take a deep dive to answer the question: how are Bitcoin and other cryptocurrencies disruptive to nation-states?

Let’s start with a story, shall we ?

Hacker arrested, but his money unseized

Germany, 2019

A hacker had been arrested, for installing cryptocurrency mining software on other people's computers without asking for their consent.

He was sentenced to two years in prison for this. And he was ordered to give the government the 1,700 bitcoins1 he had mined in this way.

Except that he refused2. Despite repeated requests from the authorities, while he was in prison.

In the end, he served his sentence, and the German authorities were unable to seize the bitcoins.

Of course, the addresses of his wallet, being known, will be monitored. And the press reported that "prosecutors have ensured that the man will not be able to access his treasure trove of bitcoins after his release".

But in reality, if this hacker knew what he was doing, he'd still have access to his bitcoins (because he may have just memorized the 12 keywords needed to restore his wallet, or hid them in various places). He may not be able to spend them right away, but who knows what he'll be able to do in 20 years' time, especially if he's moved to another country in the meantime?

Will the German authorities continue to monitor these addresses for as long as they do? Won't the statute of limitations run out after a while? What can they do if this hacker spends these bitcoins in a completely different jurisdiction two decades from now?

In any case, this is an example of a normally all-powerful government unable to seize money when it has the legal power and will to do so.

That's something new. And it's just the beginning : let's take a closer look at the ways in which cryptocurrencies are disrupting governments.

1. Crypto-currency makes the role of states in money obsolete

First of all, because it's a digital currency, with all the advantages of a natively digital technology (borderless, physically unencumbered, able to travel at the speed of light), which doesn't need governments or even any trusted third party to operate.

With Bitcoin, trust is based on mathematical laws, not trusted third parties.

This makes states obsolete as guarantors of the integrity of money, which is yet another blow to their importance and power, like the other disruptions brought about by the Internet we've been talking about in the previous articles.

This allows some people to envisage a future where - just as Church and State were separated when for millennia they seemed inextricably linked - Currency and State will be separated.

And some say it's just as desirable to create this separation, as was the separation of Church and State, which ushered in a new era of scientific and intellectual freedom and exploration.

Until recently, such a debate would have been highly theoretical3 , but today it's technically possible to achieve this - and countries, entities and individuals are already trying, as we'll see in the rest of the articles and the book.

It is possible, even probable, that one of these experiments will succeed in making this separation. Yet another blow to nation-states.

2. Bitcoin has certain desirable characteristics that modern fiat currencies lack

A fiduciary currency is a currency that has no intrinsic value, as it is not based on anything of intrinsic value such as gold or silver.

As we've seen, fiat currencies allow nation-states to create money at will... which they're more than happy to do.

Bitcoin has a maximum limit of 21 million Bitcoins that will be created, at most4 .

A state or community that adopts it can therefore no longer create money at will.

And the existence of these cryptocurrencies also indirectly limits the amount of money a state can create.

How? Because Bitcoin (and other cryptos) are a competitive currency that people can easily use (it just takes a bit of training) if ever the currency of a particular state suffers such inflation that people lose confidence in that currency.

Historical examples of alternative currencies used in times of crisis

When this has happened in history, people often turn to a substitute currency, often a foreign currency, like the Germans during hyperinflation in the early 1920s, who used foreign currencies even when it was illegal5 , just like the Zimbabweans in the late 2000s.

To stem hyperinflation, the Zimbabwean government finally made legal what everyone else was already doing, allowing the use of the currency of their choice - mainly US dollars and euros, which stabilized prices.

(In 2019, the Zimbabwean government reversed course, reintroducing a fiat currency - which started a new period of hyperinflation6.)

And this kind of episode has happened many times before in history, for example during the French Revolution in 17957 , when the collapse of the Assignat led French citizens to turn to foreign currencies such as the Dutch florin or the Prussian thaler8 .

Similarly, during the American Civil War, the Confederacy experienced hyperinflation so severe that it rendered Confederate bills virtually worthless, forcing people to exchange goods and services directly or to use foreign currencies or the currencies of individual states9 .

In Russia, after the revolution of 1917, the "trusted currency" of the tsarist regime, the ruble, suffered intense hyperinflation. The new currency introduced by the Bolsheviks, the "Soviet ruble", failed to win public confidence and citizens turned to foreign currencies, mainly the US dollar, for their daily transactions, until the regime returned the Gold Standard in 192410 .

All these historical examples show that when a national currency becomes unstable, people look for alternatives to preserve their purchasing power, and the fact that it's illegal hardly stops them.

Until now, people suffering from hyperinflation have only had the choice of 1) using a substitute that have a recognized value, such as gasoline tickets, phone cards, etc. 2) using the currency of another state or 3) bartering.

The new option of using cryptocurrencies during economic crisis

Today, Bitcoin - and other cryptocurrencies - offer an additional option.

For example, in Venezuela, faced with crippling hyperinflation and a rapid devaluation of the bolivar, some citizens began using cryptocurrencies, notably Bitcoin, as a means of exchange for goods and services11 .

The use of cryptocurrencies has become so common12 that the Venezuelan government launched its own cryptocurrency, Petro, in 2018, in an attempt to stabilize the economy and circumvent international sanctions13 . However, confidence in this government currency remained low, and Venezuelans continued to use Bitcoin and other cryptocurrencies despite restrictions and bans.

In Greece, during the sovereign debt crisis in 2015, some citizens turned to Bitcoin and other cryptocurrencies when strict capital controls limited access to bank deposits and cash: bitcoin transaction volume in Greece increased by 500% between mid-June and mid-July 201514 . Many Greeks saw Bitcoin as a refuge from economic uncertainty and a way to transfer money out of the country.

It's true that the price of Bitcoin is highly volatile today, making it difficult to use as money for everyday transactions, but it's also normal for a brand-new means of monetary exchange to experience upheavals as it replaces some of the existing assets.

What's more, when you look at the long-term price trend, one thing is certain:

The price is going up.

Of course, it will stop at a certain level at some point. And Bitcoin’s price will probably stabilize at that point (say, in a decade or two). This will probably make it an attractive currency for everyday use.

However, Bitcoin doesn't even have to be used as a currency: it could just as easily replace gold as a safe haven, or become a new asset class in which to invest.

That doesn't stop cryptos from having the power to compete with nation-state currencies: in fact, as you probably know, Bitcoin was the first crypto-currency, but today it's far from the only one.

Because, as I write this, there are already over 9,000 cryptocurrencies in circulation15, and that number is growing.

Even if many of these cryptocurrencies have no real value (because they're just carbon copies of other cryptos), some have innovative features that set them apart from the rest, and all are participating in a new market: that of all currencies that can be used in one place, because due to their intrinsically digital nature, all these currencies have no borders and can be used by anyone with a smartphone.

That's 6.92 billion people at the time of writing16, or 86% of the world population.

This is profoundly disruptive for nation-states: historically, competition for their currencies on home soil was very limited, and generally reserved for the most extreme situations, some examples of which we have seen above.

Today, this monopoly has been completely overturned.

We can well envisage a future where everyone is free to choose which currency to use in their daily lives, and for other purposes, as these currencies will be easily usable on a smartphone, regardless of the user's geographical location.

In fact, some jurisdictions already offer this choice, as we shall see in later articles.

3. Cryptocurrencies are beyond the reach of nation states

Thanks to encryption

Do you remember what I shared with you in How encryption is disrupting nation-states, about how data encryption, properly used, can withstand even the most powerful nation-states' disproportionate resources?

This applies to cryptocurrencies that are designed with this type of encryption.

For the first time in history, this has created money that can no longer be seized by governments, yet another blow to their power.

If, for example, you've installed a Bitcoin wallet on your computer and encrypted it with Veracrypt (or other encryption software), no one will be able to access it unless you agree to reveal your password.

Even without encrypting your computer, you can configure your Bitcoin wallet to ask you for a password every time you use it, which will accomplish the same result: your money will be elusive.

Ditto on your smartphone.

Of course, this requires you to choose a password strong enough to withstand computer attacks - I'll tell you how to do this in the articles dedicated to computer security.

Thanks to their easy concealability

What's more, it's even possible to hide your fortune completely.

How do you do it? In general in crypto it is advisable to have two types of wallets:

The one for everyday life, in which you will put just a few cryptos for your daily needs.

The one that will store the bulk of your wealth, which is what we call "cold storage", in a device designed solely to manage cryptos, and which you will only connect to a computer when necessary (i.e., rarely).

Most of these cold storage machines use an encryption key generation mechanism known as "deterministic":

They will give you a list of 12 or 24 keywords, which you can learn by heart if you wish17.

You can then dispose of the machine if you wish...

All you have to do is enter these keywords into any identical machine (and often even into a different brand of machine using the same principles), and that machine will retrieve the access key to your cryptocurrencies!

This means that smart people :

Buy a machine of this type (ideally by cash and in-store, if they want to leave no trace of their purchase, or by delivery to an address other than their own), generate the list of 12 or 24 keywords

Learn this list of keywords by heart

Copy/paste several generated wallet addresses (to be able to send cryptos to them)

Then throw away the machine

And there will be no more physical evidence that they have such a machine.

This means that :

These people will be able to cross any border with a huge fortune without customs officials being able to detect anything.

In the event of suspicion or even arrest by a government (or in the case of crimes such as robberies or kidnappings), these people will be able to deny having a fortune in cryptos.

And you don't even have to go that far: many of these machines offer a similar option to Veracrypt's hidden partition - you have "normal" access via the list of 12 or 24 keywords (plus a shorter password to access the machine more easily) AND hidden access with an additional keyword and a different password, the existence of which is impossible to guess.

So if you're forced to reveal your password, you can choose to reveal the one for your normal account (where it's recommended to leave some cryptos for illusion) and not the one for your hidden account... and your attacker will have no way of knowing that you have a hidden account on the machine18.

Alternatively, you can simply buy two cold-storage keys: one for your "official" account, which you'll keep, and another for your hidden account, which you'll discard once you've generated it.

This makes the task of anyone who wants to steal or seize your money even more complicated: how can you seize what you don't know exists?

That's not to say it's a sure-fire way out: if you bought your cryptos on a centralized exchange platform, it asked you for documents to prove your identity and physical address (due to KYC regulations, "Know Your Customer", which we discussed in detail in this article), and it's relatively easy for public authorities to ask major platforms for a record of all transactions involving you.

And if you haven't taken precautions once you've transferred your cryptos to addresses you own, it's easy to find out what you've done with them afterwards, and whether you still have any.

But it's always the same: criminals know how to get around these kinds of regulations for their operations, as do privacy-minded people and the smartest activists.

This represents yet another blow to the power of governments, which, in attempting to regulate these uses, are above all creating friction for honest users - which also contributes to their loss of legitimacy and prestige, as we saw in a few articles, and shall see again.

Thanks to the possibility of making transactions completely anonymously, with the right parameters

By default, most cryptocurrencies are not truly anonymous, contrary to popular belief: they are in fact pseudonymous.

Why, and what does it mean?

As I mentioned in the previous article, the blockchain is a public database, i.e. visible and verifiable by everyone: anyone can see that a given Bitcoin or Ethereum address has sent a given amount to a given address.

This poses no particular problem as long as the owner of an address is not known. It is much more of a problem when this information is available: it is then possible to know all the transactions made by this person with this address.

And this also means that, by default, if you have all your Bitcoins (or any other crypto) on a single address, anyone to whom you make a payment or who sends you a payment knows the state of your wealth, where your Bitcoins come from, and how you use them, with a complete history of your transactions since the beginning of the use of this address.

It's very, very bad from a privacy point of view.

And of course, most people buy their cryptos from marketplaces that have KYC (Know Your Customer) identity verification procedures, which mean that these marketplaces (as well as any public authority that legally obtains customer information and any hacker who illegally obtains it) know who is behind the address used to receive the cryptos bought from them, and can see what use is being made of these cryptos.

Fortunately, this problem can be mitigated by various solutions:

By default, any modern crypto wallet generates a new, blank address (which has never been used before) to receive a new payment, thus ensuring perfect confidentiality for the person receiving the money (but not for the person sending it).

At the time of writing, the Lighting Network payment system, an overlay to the Bitcoin network, is becoming the default payment system for small and medium-sized transactions. In addition to instantaneous execution speed, this system also offers greater confidentiality for the buyer, as the seller sees the transaction coming from an address other than that of the payer in most scenarios. Similar solutions are currently being developed for Ethereum.

You can buy cryptos on decentralized platforms that have no KYC identification process, such as Bisq or Hodl Hodl.

Crypto mixing (CoinJoin): rather than sending a crypto sum directly from one address to another, you can go through a CoinJoin, which is a system for blending together the payments of several people. So, if your payment is mixed with that of 50 other people, it's very difficult to know exactly whose cryptos are on the other side of the mixing service: you can still track the transactions, but you don't know who is making them among the 50 people.

Some wallets, such as Wasabi Wallet (for Bitcoin), mix by default as soon as funds are received, and display a simple indicator that tells you how much "privacy" your Bitcoins have.

Another well-known wallet with a similar mechanism is Samurai Wallet.

A similar Ethereum blending system, Tornado Cash, proved so disruptive to the US state, that the US Treasury banned all US persons and entities from using it in August 202219 , blacklisting thirty-eight Ethereum wallets associated with Tornado Cash.

All U.S. entities and citizens are therefore prohibited from using the service, and many U.S. companies that used to offer an easy-to-use interface have stopped doing so.

But, and this is very important, any American can still continue to use Tornado Cash because it's a smart contract on the Ethereum blockchain (we'll see what that is a little further down), and is therefore unstoppable by any state.

An American user using it would therefore be doing so illegally, but there's nothing technically to prevent him from doing so. Once again, this is a major disruption for governments.

Thanks to cryptocurrencies designed to be untraceable

There's also a "radical" solution: use a cryptocurrency designed from the outset to be untraceable, and maximize privacy, with no special operations required.

Of all the cryptocurrencies with these characteristics, Monero is the most widely used at the time of writing.

And Monero is so effective that a Europol analyst, Jerek Jakubcek declared in 2020 that its use combined with that of Tor prevented any investigation from continuing20 .

And 2020 the US tax authority, the IRS, offered a $625,000 bounty to any person or company able to develop tools to track cryptocurrency21 .

This has reached the point where today, criminals are increasingly using Monero instead of other cryptos, abandoning Bitcoin in particular because of its transparency22 .

In fact, it can be used to reinforce the confidentiality of Bitcoin, Ethereum and many other popular cryptos: simply exchange your bitcoins for moneros via a decentralized service23 , then re-exchange your moneros for bitcoins24 , and you're done.

(Note that if you've bought your cryptos on a centralized platform with KYC processes, someone with access to those purchases, be it an administration or hackers, will have an idea of the general amount of crypto you have. The process I've just described won't be able to hide that, but simply what you've done with those cryptos).

Such a completely untraceable currency, coupled with the powers conferred on it by digital technology - no real physical presence, travels across borders at the speed of light, etc., is again profoundly destabilizing for nation-states, just as are the tools that make transactions in more transparent cryptocurrencies anonymous.

Thanks to the fact that the best cryptos are a massive, decentralized, borderless phenomenon

Which is extremely disruptive for states, to the extent that history shows that they almost systematically lose out to these phenomena, as we saw in How the Internet makes Governments Impotent to Tackle Bottlenecks.

4. Smart cryptocurrencies will create new organizations that are borderless by default

Another major innovation enabled by cryptocurrencies is that, as they are natively digital, they can be programmed.

This enables incredible innovations that are currently impossible to achieve with conventional currencies.

One of the most striking innovations is "smart contracts", which, like computer programs, can interact with the money on the blockchain on which they are located according to predefined rules.

This opens up a whole new field of possibilities.

This field still has little to do with Bitcoin: even though it is theoretically programmable, it still has few applications based on smart contracts because its community is fairly conservative, which has the merit of making it a stable crypto, but has the disadvantage of slowing down innovation25 .

On the other hand, many other cryptos are embracing this innovation (and others!). These include Ethereum, which I mentioned in the previous article, which at the time of writing is the crypto with the most applications developed26.

Among these applications based on cryptocurrencies and smart contracts, those with some of the greatest potential, including for disrupting nation-states, are DAOs.

DAOs stand for Decentralized Autonomous Organization.

Great, but what exactly is it?

Basically, it's a structure that organizes the cooperation of its members (like a company or an association), but without a central authority.

Members of a DAO own DAO tokens, which are stored on the blockchain, and members can use these to vote on the entity's initiatives.

Smart contracts are implemented for the DAO, and the code governing DAO operations is made public.

A DAO aims to improve on the classic management structure of many companies or associations. Instead of relying on a single individual or a small group of individuals to guide the direction of the entity, a DAO typically intends to give each member a voice, a vote and the ability to propose initiatives.

A DAO also strives for strict governance that is dictated by a program on a blockchain.

And, a DAO is :

Natively borderless: anyone with a token of this DAO can integrate it, regardless of their physical location, and therefore the country in which they are located.

Has natively no legal status

Is natively leaderless

Has natively no physical location: it exists above all in the blockchain (even if its members live somewhere)

Can be made up of completely anonymous people

Can you see how profoundly destabilizing this is for a government? The structures known to the Nation-State :

Are necessarily contained in a physical location, i.e. within borders (even a multinational company is a company with physical locations in several countries)

Have legal structures (except certain criminal organizations)

And always leaders and a management structure

Who are known and identified !

DAOs completely disrupt this, and this again makes for a type of organization that makes it difficult for nation-states to control: creating a DAO is easier (technologically) than investigating it and understanding who its members are (if they wish to remain anonymous), which again represents an inversion of the balance of power between attack and defense, which as we saw in the 5th principle of 10 Principles of History for predicting the future, is extremely disruptive for the powers that be..

Here are just a few of the thousands of interesting DAOs:

Uniswap

This is a decentralized exchange (DEX) on several blockchains, and originally only Ethereum, which allows tokens from these blockchains to be natively exchanged.

On Ethereum, for example, you can exchange ETHs, USDTs and USDCs (tokens at parity with the US dollar), and dozens of other tokens, as well as NFTs.

With the launch of Uniswap V3, a governance token called UNI has been introduced. UNI token holders have the power to propose and vote on changes to the platform.

This enables the community, rather than a single central entity, to make decisions about the development and future direction of Uniswap. In this sense, Uniswap functions as a DAO, as it is directed and managed by its community of users through the UNI token governance mechanism.

Friends With Benefits

A web3 club where holders of a minimum amount of the DAO token (FWB) can meet to network and collaborate.

This can be done online via a Discord server, or physically: there are individual hubs for different cities, so users can meet like-minded web3 people in their own locality.

Maker DAO

MakerDAO is like an online club where members work together to create and manage a digital currency called “Dai”.

Imagine Dai as a virtual voucher that's always worth around $1, no matter what happens in the cryptocurrency world. That's what is called a "stablecoin".

Other stablecoins, such as USDT or USDC, ensure parity with the dollar using assets from the traditional financial world (dollars in bank accounts, US Treasury bills), assets which are therefore centralized and can be attacked by governments.

To ensure that Dai retains the value of a dollar while remaining decentralized, MakerDAO members use automated rules that are written into smart contracts, and the fact of having to post a deposit: if someone wants to create Dai, they must first give some sort of deposit, as if they were borrowing a game from a friend.

This deposit is often another digital currency such as Ethereum. If the value of this deposit changes too much, the system automatically asks the person to add more deposit or refund part of their Dai.

It's like a balancing act to make sure everything stays stable.

MakerDAO and Dai are considered to be the first examples of decentralized finance to see significant adoption.

How ShapeShift went from a company to a DAO

In 2014, after seeing the difficulties of buying certain cryptocurrencies, Erik Voorhees imagined a platform where you could simply "send one cryptocurrency to receive another". This is how ShapeShift was born.

Initially, it was a Swiss company, but serving customers from all over the world, offering cryptocurrency exchange without a KYC (Know Your Customer) process, enabling anyone to exchange tokens without creating an account.

However, faced with regulatory pressures in 2018, ShapeShift had to integrate KYC standards, resulting in the loss of many customers.

In response to the emergence of decentralized finance (DeFi) and decentralized exchanges such as Uniswap in 2020, ShapeShift took a radical decision: to shut down the company and decentralize.

This was done in 2021: the company abandoned its corporate structure to become a DAO and decentralized exchange (DEX). This transition was accompanied by the distribution of the FOX token to over a million customers, and 100,000 DeFi community members, and all code was released as open source27 .

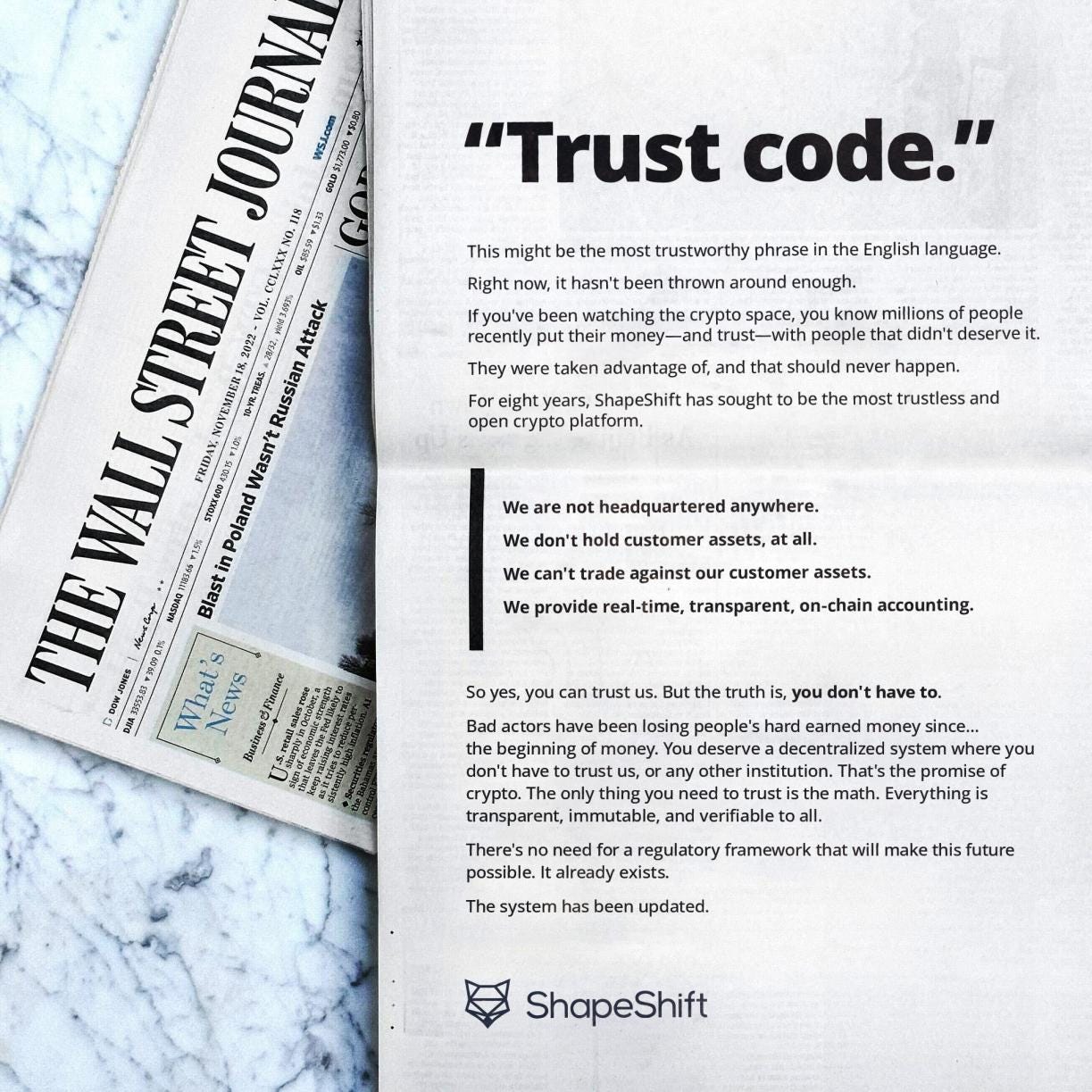

In 2022, they took out an advert in the Wall Street Journal starting with "Trust the code28 ", which included these very interesting lines:

We are not headquartered anywhere.

We don’t hold customer assets, at all.

We can’t trade against our customer assets.

We provide real-time, transparent, on-chain accounting.

This sums up many of the major advantages of DAOs.

Physical vs. digital incarnation

One way for governments to regain some of their power is to force these DAOs to "incarnate" physically on their territory, by forcing them to take on a legal structure.

But this requirement is completely artificial: DAOs don't need to do this, and "embodying" themselves physically can even create friction in their operation.

Throughout the book and other articles, we'll see this growing tension between governments that force digital entities into physical embodiment to better control them, and digital entities that don't need to, and see physical location as secondary, changeable, and not determinant.

So why wasn't Satoshi Nakamoto prosecuted?

We don't know for sure the real reasons for this absence of prosecution, whereas the creators of E-Gold and Liberty Reserve were, but we can deduce 3 major reasons:

1. Satoshi Nakamoto is a pseudonym, and we don't know who this person, or group of people, is.

Would his anonymity have withstood a serious police investigation, or worse, from a 3-letter agency like the NSA or CIA?

Maybe, maybe not: it all depends on the precautions Satoshi has taken, and his total absence of error (which could have revealed his IP address, for example, or other clues enabling his identity to be determined) during his years of participation in Bitcoin.

2. He stopped participating in Bitcoin under this pseudonym, and all communication, quickly.

He worked on Bitcoin from 2007 to December 2010, then ceasing all code and forum participation, then responded increasingly erratically to his emails, then ceased all communication a few months later, just after Gavin Andresen, one of the developers heavily involved in Bitcoin, revealed to him that he had been invited by the CIA to give a presentation on the cryptocurrency29 .

Coincidence? No one knows, but it may have been the last straw.

In any case, coupled with his anonymity, this probably helped him greatly to reduce his exchange surface with government agencies.

3. He created Bitcoin so that it would be decentralized, and therefore not dependent on him.

Even if Satoshi had been prosecuted, this would have done nothing to stop Bitcoin, which soon spread its wings to live its own autonomous life.

This probably reduced the motivation of the various agencies to pursue it. We'll see in the rest of this blog (and the book) that increasing the complexity you represent, while decreasing (or keeping low) the motivation of government agencies to investigate you, is often a winning recipe for peace of mind.

Why hasn't Bitcoin been stopped like E-Gold and Liberty Reserve?

Because Bitcoin is a massive, decentralized, borderless phenomenon, and as we saw in How the Internet makes Governments Impotent to Tackle Bottlenecks, governments are powerless to combat these phenomena.

They can stand in their way - often at considerable cost to society, as we saw in How KYC and AML are destroying the world - but not stop it.

In the next episode

We'll look at how the Internet has disrupted nation-states in another way: by making it harder to identify people who know how to remain anonymous.

In the meantime, click here to follow Disruptive Horizons on Twitter (and here on Nostr), and debate these topics with me, or just share the love :)

The series on the disruption of nation-states by the Internet

This article is the 6th in a series on the disruption of nation-states by the Internet.

Here are the first five articles in the series:

Valued at $65 million at the time this story broke (early 2021)

See, for example, economist Friedrich A. Hayek's 1977 speech "A Free-Market Monetary System".

If you're wondering how Bitcoin could become a large-scale currency with such a limitation, understand that each Bitcoin is made up of 100 million sub-units, called satoshis or sats (which are like centimes, if you like). If one day a Bitcoin reaches 100,000 euros, for example, and it's no longer practical to count in Bitcoin for everyday transactions, it will be possible to count in sats, or kilo-sats, and so on.

When Money Dies, Adam Fergusson, 2010

"The History of Monetary Collapse in Zimbabwe", River Financial, 2020

143% inflation per month at its peak, Monetary Regimes and Inflation: History, Economic and Political Relationships, Edward Elgar, 2003. [REF A VERIFIER!!!]

"Fiat Money Inflation in France", Andrew Dickson White, 1896

"Money and Finance in the Confederate States of America," Marc Weidenmier, Claremont McKenna College.

"An Economic History of the USSR", Alec Nove, 1989

"Bitcoin v bolivar: can cryptos save Venezuela?", Felipe Araujo, Raconteur, 2019

"As Venezuela's economy regresses, crypto fills the gaps", Brian Ellsworth, Reuters, 2021

"The Use Of Bitcoins In Light Of The Financial Crisis: The Case Of Greece", Efpraxia D. Zamani, Ioannis Babatsikos, 2017

Which is easy enough to do with the storytelling method I shared in chapter 3 of "The Way of the Intelligent Rebel" ;)

You don't have to do this, of course. I myself only use a normal account. Or maybe I use a hidden account. Who knows? :)

"U.S. Treasury Sanctions Notorious Virtual Currency Mixer Tornado Cash", U.S. Department Of The Treasury, 2022

"Monero transactions untraceable, says Europol analyst", Decrypt, 2020

"Pilot IRS Cryptocurrency Tracing, IRS, 2020

"Monero emerges as crypto of choice for cybercriminals", Financial Times, 2021

For example, the Cake Wallet, or Samurai Wallet

In more than one transaction to avoid being identified by the similarity of the amount of the outgoing transaction to the incoming transaction

This began to change in early 2023, however, with the launch of Bitcoin Ordinals, which allow data associated with sats to be stored on the blockchain, enabling certain forms of smart contracts, including NFTs (Non-Fungible Tokens), unique tokens primarily used to store one-off works of art on the blockchain. But the pace of innovation in the bitcoin ecosystem is slower than in other cryptos, including Ethereum.

"List of Top Smart Contract Platforms", Dmitry K., ND Labs, 2023

" ShapeShift is Decentralizing "Erik Voorhees, 2021

ShapeShift tweet from November 18, 2022

"Coincidence? Bitcoin developer visited CIA, then Satoshi Nakamoto disappeared", Ana Nicenko, Finbold, 2023