Reduce Your Taxes and Be Freer: Unleash the Power of the 7 Flags

An amazing asymmetrical defense against government overreach

Note: In the previous series of articles, corresponding to Chapter 7 of my forthcoming book, we saw how to break the shackles of monocountrism and become free.

This article is the 2nd in a new series on how to go further by integrating asymmetrical defenses against overeager states.

Here is the 1st article in the series:

The essential principle, the one that will be the foundation of your entire strategy, is to stop being a mono-country.

And the most important underlying principle is that you have to leave your home country: it's certainly possible to adopt a multi-country legal strategy while living in your home country, but your defense and autonomy will be considerably weakened as a result.

Because as we briefly saw, and as we'll see in more detail later on, of all the countries in the world, it's your home country (or the one in which you've lived the longest in your life) that takes you most for granted, while dozens of other countries are fighting to roll out the red carpet and welcome you in the best possible conditions.

Beyond this, it's also important not to put all your eggs in one basket: drawing boundaries in your personal and professional organization is the equivalent of erecting walls, building a dungeon and digging moats around your castle - all things being equal, we'd rather attack a less well-defended target.

And the best way to do this is to adopt the seven-flag strategy.

Your castle: the seven flags

The concept, which originally comprised three flags, was devised in the 1960s by author and international investment consultant Harry D. Schultz.

The idea was to separate 1) your nationality from 2) your country of residence and 3) the country where your assets or business are located, and to choose each of these flags in a way that maximizes your quality of life.

This idea was then taken up by author William G. Hill, who extended it to five flags in the 1980s, then to six flags in the 2000s.

I'm adding a 7th . The seven flags strategy consists of separating your business and your life between different countries, to add a sufficient number of borders to make your castle as impregnable as possible, and to benefit from the best value in your country's governance services.

I'm going to share with you my own interpretation and implementation of this strategy, which is not necessarily what its inventors would have imagined, as they implemented it at a different time.

An important principle

Ideally, each flag should be in a separate country or countries: there should be as few common countries as possible between each flag.

You don't have to follow this principle completely, but the closer you get to it, the better.

Likewise, two flags are better than one. Better three than two, etc.

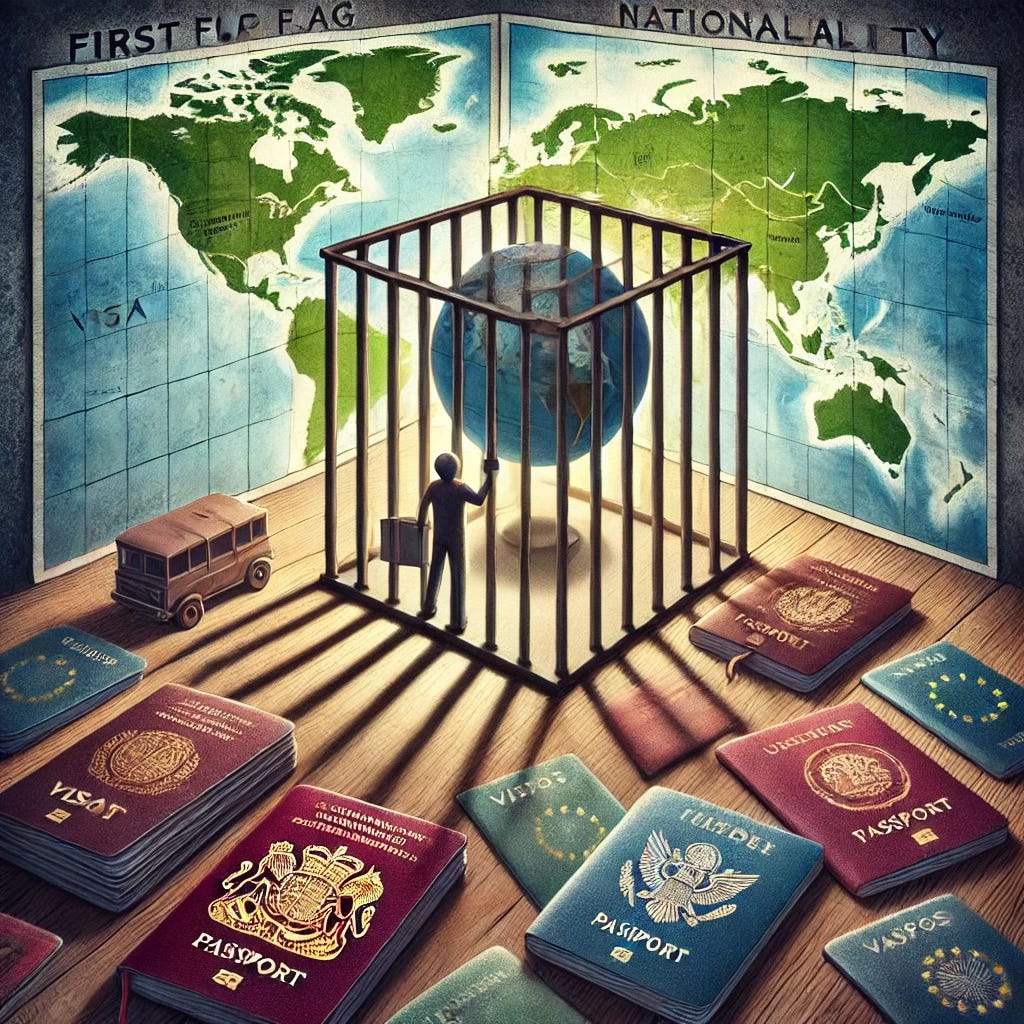

1st flag: your nationality

Ideally, you should have nothing left in your country of nationality, as it takes you most for granted, and is most motivated to bring you back into its tax net.

If you're lucky enough to have a nationality by birth that has a lot of advantages (access to many countries without having to apply for a visa, for example), that doesn't tax you on your citizenship, and that doesn't force you to do something that goes against your values (like forcing you into military service when you're anti-militarist), then you've got an excellent passport.

Most Western countries fall into this category. If this is your case, there's no reason to get another one (even if there are advantages to doing so, as we'll see...).

The big exception, of course, is the United States: as we've seen, it's the only Western country that taxes people on their citizenship rather than their residence. If you're an American, even if you've lived abroad all your life, you still have to file a return, and possibly pay taxes, to the IRS every year.

It's a time-consuming operation that takes forever for Americans abroad.

In short, you're in jail everywhere.

If you are unfortunate enough to have such a passport, the best thing to do is to acquire another one and renounce your nationality. I'm sure many of us wouldn't be happy to do this, but it's necessary if you really want to be free.

If one day France, or the European Union, decided to tax its citizens according to their nationality, I'd probably give up my French passport.

I wouldn't do it gladly, because it's obvious that this nationality represents my roots, and that many memories and emotions are attached to it, but I'd do it anyway, because I couldn't bear the idea of thus being a neo-serf, owner of my "lord", to whom I'd be obliged to render accounts even if I no longer lived on his territory.

2nd flag: your tax home

It's the country in which you are a tax resident. It's the one that gives you the best value for the governance services a state provides.

The world is a vast place, and there are probably dozens of countries that can offer you a better combination of quality of life, adventure, light taxation and exoticism than your native country.

It's up to you to decide which of these criteria are most important.

For example, if you don't think it's right for a government to know everything about your finances, as most politicians - right and left - did until the beginning of the xxe century, you can choose a country which, among other criteria, is not too intrusive in this respect.

Most countries participate in the automatic exchange of information, and therefore receive information from all over the world on all financial accounts belonging to you, but some countries have chosen not to receive information concerning their residents, and others do not participate at all.

Note that I absolutely do not recommend choosing a country of residence just because it has low taxes and/or doesn't stick its nose in your business: life is short, and there's no point burying yourself in a place you hate just to pay less tax!

At the end of your life, you'll remember your love letters more than your bank statements (or so I hope).

But, again, you can choose a country that represents the best combination of your criteria, the best value for money.

And if you're hesitating between two countries you love just as much, why not choose the one with the lowest taxes?

Beyond that, depending on your objectives, different types of states are ideal:

A "normal" country

If you want to choose a country that you like enough to spend a good part of the year there, you'll find that many of them roll out the red carpet for foreigners, including offering them much lower taxes. We'll talk more about this in the next article.

A country optimized for digital nomads

Some countries allow you to become a tax resident without spending much time there: Cyprus, for example, simply requires you to spend two months a year on its territory, which is perfect for nomads wishing to travel the world.

Here, whether you like the country or not is less decisive than in the first case, but burying yourself for even a few months a year in a country you hate isn't worth it, so keep that in mind.

3rd flag: the place for your business

This is the country in which you domicile your company.

Note that it is nowadays almost impossible to set up your business for tax purposes in a country other than your country of residence if you are the manager, as many countries have introduced CFC (Controlled Foreign Companies) rules which basically stipulate that the company is deemed to be domiciled for tax purposes where the management is domiciled.

So if, for example, you live in Belgium and set up a company in Dubai, which you manage from Belgium, it's legal, but you have to declare your company to the Belgian tax authorities, and it will have to pay the same taxes as a normal Belgian company. Failure to do so constitutes aggravated tax fraud, which is severely punished in many countries.

And if the company has employees in other countries, this can create "permanent establishments" in those countries, which are taxed in those countries at the level of the added value produced. If you want to avoid this, hire freelancers - even if, as we've seen, in practice it's very difficult for governments to control this.

Tax domicile for your company in a country other than your country of residence is possible if :

Your country of residence has no CFC rules.

There are fewer and fewer, but at the time of writing, for example, the following countries have none: Hong Kong, Monaco, Singapore, Georgia, Panama, Thailand, the Dominican Republic (and many Caribbean countries), and even Switzerland (!), as well as many other small and medium-sized countries.

Or that you appoint a manager to run your business for you from this country. In this case, the company will be domiciled for tax purposes in that country.

Some companies offer turnkey management services, but this is often just a front: in the event of an audit, you risk a requalification as aggravated tax fraud - the management functions must be real, there must be "substance".

This notion of substance is very important in international tax law: the authorities don't like empty shells. That's why a company theoretically based in Dubai, but managed from Belgium or another country, doesn't pass muster, and from the point of view of governments this is understandable.

Note, however, that it is perfectly legal in most countries to :

Setting up a business in a country other than your country of residence

Managing it from your country of residence

By declaring it to the tax authorities in your country of residence, and paying taxes as if it were a local company

"But what's the point of doing that?" you might ask.

Good question.

The answer is that it gives you extra protection by creating a legal asymmetrical friction.

But this trick is highly theoretical: I've never met anyone who uses it.

One reason for this is probably that finding an accountant willing to handle the bookkeeping for such a company can be complicated. But another is that many people don't think enough outside the box.

The most obvious use for this flag

... is to place your company in a country where you won't have any customers.

The easiest way is to live in a country whose language is different from your native one, and to domicile your business there, which will sell on the web in your native language (or a language other than that of the country in which you live).

This represents a very strong and simple asymmetrical defense: unless you're a native English speaker1 , there are plenty of countries that don't speak your language. If the administration in the country where you live doesn't speak the language in which you do business, can you see how this greatly reduces your exchange surface with that administration?

Another possible use for this flag

Creating a U.S. LLC while becoming resident in a territorial tax jurisdiction. We'll talk more about this in later articles.

4th flag: your playgrounds

These are the countries where you spend time during the year.

If you want to follow the theory to the letter, remember that the countries in each flag must be separate. But again, this is just theory, which I've never seen applied 100%.

Basically, the idea is to spend as much time as possible in countries where you have no legal existence - as a tourist, that is - to minimize the power the local government may have over you.

Of all the flags, this seems to me the most extreme - you don't have to go that far to have a good defense against states, but if you like to travel a lot, why not? But I don't see the point of traveling all the time for the sole or even main purpose of minimizing your exchange surface with governments.

As a bonus - if you travel all the time primarily because you enjoy it - that's OK.

Nevertheless, this flag can enable you to live for several months a year in countries with heavy bureaucracy and tax burdens, without having to suffer these inconveniences.

To stay in the 80/20 range, there are two main ways of organizing:

1st possibility: Choose a "flexible" base with few constraints and live as a "complete digital nomad".

You settle in Cyprus for two months a year, for example, which is enough for that country to consider you a tax resident, and you travel the world for the rest of the year.

However, to be on the safe side, it's better to spend more time each year in your country of tax residence than in your country of nationality (or former country of residence), as otherwise the country you're from may consider you a tax resident.

However, this depends on the country's internal tax residence criteria, and the treaty between that country and your country of residence, but to keep things simple it's a rule that works in most cases.

It's also worth noting that you don't necessarily have to be a tax resident somewhere: you can set up home in Dubai, for example, and stay there for one month a year, which makes you a resident, but not a tax resident.

This is not a problem, provided no other country considers you a tax resident. Note, however, that to leave certain countries for tax purposes, you must be able to demonstrate that you have acquired another tax residence.

If this sounds a bit complicated, don't worry, I'll explain it all in more detail later.

2nd possibility: Choose a few countries in the world that you like and live there for a few months a year.

Let's say you make a list of four countries you'd like to live in, say, for example, the United States, Spain, Mauritius and Japan.

You have a web-based business and can therefore live anywhere in the world. You choose not to choose: you're going to live in these four countries for the next twelve months, and maybe even several years!

How ? You can :

Choose the country that offers you the most flexible immigration conditions and the lightest taxation as a legal and tax base.

For example, by examining the conditions of each country on the list, you opt for Mauritius.

Live three months a year in each country, as a resident in your home country and as a tourist in other countries.

And there you have it! You have all the advantages of these countries without the disadvantages. As many countries allow three-month tourist stays without a visa (if you have a "good" passport), you don't have to do anything special in other countries, no registration, no taxes to pay (apart from VAT or equivalent on your consumption, which remains reasonable). You can probably do this for as long as you like, without any problems.

Do you see how profoundly disruptive this is for nation-states? And if they wanted to fight such an arrangement, how exactly could they do it? By preventing tourists from coming back too often?

But does someone who spends three months a year in a country really come back too often? And if you put in place a rule that says tourists can spend three months in the country every two years, the people concerned will simply go to the country next door.

What exactly is that going to change, apart from costing your country revenue by reducing the number of tourists?

And above all, what problem does it solve, exactly?

A life no longer confined within the borders of a single state is now possible and accessible, not only to all web entrepreneurs, but also to any employee working remotely.

Of course, if you have to do synchronous work, you're more limited in the time difference you can accept, but dozens of jurisdictions are still open to you.

You can also see how people living this way profoundly disrupt not only the state but also the nation: many, many digital nomads are "Anywhere" rather than "Somewhere", they can live in a large number of countries around the world as long as they offer good conditions, without being attached to any particular place.

And if they particularly like one or a few of them, they can live there for a few months a year, which is usually quite enough.

Note that this way of life allows you to take advantage of the best seasons in each location, and avoid the most difficult months, which could otherwise make a place uninhabitable.

For example, when I lived in London, I made sure I wasn't there from January to March: these are cold months, gray and dark, with three layers of clouds on top of each other, rainy, and the sun sets at 4:30 pm. The horror.

On the other hand, summer in London is a caress, with the sun setting at 9 p.m., and we generally escape the summer heat that plagues the rest of Europe.

Similarly, I avoid spending the summer in Dubai, and generally leave from June to September inclusive, to avoid the sweltering heat, the 50°C/122°F days, and the noticeable slowdown in life.

On the other hand, winter in Dubai is a caress, with temperatures between 20°C/68°F and 25°C/77°F, and countless outdoor activities.

Every place has its best and worst times, and the geographic freedom afforded by the Internet allows us to magnify the advantages of each location.

5th flag: your investments

These are the countries where you put your investments.

Some countries offer more protection for certain types of investment than others; others represent better opportunities than your other flag countries; still others are convenient for investing in other countries from their territory, and so on.

For example, if you want to invest in the stock market, you need to open an account with a broker. You can, of course, open an account with a broker in your country of residence or business, but why not also open one in a country renowned for the quality of its financial services and the difficulty other countries have in sticking their noses into your business?

Singapore has this reputation, and you can open an account with one or more brokers there 1) which you can of course access remotely just as well as accounts with your national broker and 2) while still having access to most of the world's stock exchanges.

Some brokers accept remote account opening, others require you to come to Singapore, which you can easily do on vacation in Southeast Asia.

Once again, you see the principle of asymmetry: it doesn't take any more time to manage an investment account in Singapore than an investment account in your own country, thanks to the Internet, but it does anchor your investments in a jurisdiction that creates enormous friction for any government agency that might want to investigate and seize your assets.

This is not to say that you can use this system to evade taxes: today, with the automatic exchange of information, the Singapore broker will send information on your account to the tax authorities in your country of residence every year.

And most countries require you to declare your foreign accounts if you are resident there, so don't forget to do so.

But there is a difference between a declared account, and an account that the government can freeze at the click of a button, or for which it has to go through a complicated legal process abroad to do the same..

Eggs and baskets

Many investment specialists and investors will tell you to diversify your investments, not to put all your eggs in one basket.

And they're right.

Except that most of them have a blind spot, because they're mono-country: they may have diversified investments, but they're all in the same country, the same legal zone, the same currency zone.

So setting up this flag is also a way of truly diversifying your investments: it's healthier to invest in different legal and monetary zones.

Legal, to avoid all your investments being affected by a single change in the law.

Monetary, to prevent the ups and downs of a single currency from affecting all your investments.

6th flag: your bank accounts

Having bank accounts outside your country of residence is all the more important today as we have seen the example of the Cyprus economic crisis and the confiscation that took place: in 2013, faced with a serious banking crisis, the Cypriot government, under pressure from European institutions, imposed a "bail-in," where bank deposits over 100,000 euros were drained to recapitalize the failing banks 2.

The irony? Cypriot residents who had accounts abroad, including in another eurozone country, were not worried!

The European Union thought this was a really good idea, and has since explicitly authorized itself to levy bank accounts worth over €100,000 from its residents in the event of a bank failure3 (!)

What's more, the example of the frozen accounts of demonstrators against overly severe COVID measures in Canada, discussed here, shows just how much having accounts only in our country of residence makes us weaker in the face of a state that oversteps its powers.

So we might as well set up this asymmetrical defense, because today it's easy to open a bank account in another country via fintechs like Wise or Revolut, for example.

It's also a good idea to have an account in a neutral country such as Georgia, Turkey, or in countries other than your country of residence.

And again, it's generally easy to open euro and dollar accounts at these banks, and to get an international bank card.

Don't forget to declare these accounts to the tax authorities in your country of residence if required (this is the case in most countries).

7th flag: your digital assets

These are the jurisdictions in which you place your digital assets.

What are your "digital assets"?

Typically :

Your email provider

Your websites

Your cloud file service

The Internet makes the world flat.

It doesn't matter whether your email provider is located right next door to you, or on the other side of the planet.

This is also true, to a lesser extent, for your websites: you don't want the hosting to be too far away physically from where most of your visitors are, for performance reasons, but you don't need the server to be located in your country .4

Here again, we have an easy-to-use asymmetrical defense: putting our digital assets elsewhere than in our own country creates friction without taking up any more of our time.

Your email provider

Let's take a simple example: let's say that, like the majority of the population, you use Gmail5.

Gmail belongs to Google, of course, and Google has a physical presence in many countries.

Physical presence means a maximum exchange surface with a nation-state and its government agencies.

In most countries, the tax authorities can obtain any document concerning you from any private company, without a warrant6.

This means that the tax authorities can ask Google for access to :

All your e-mails

Your complete search engine history

All the YouTube videos you've viewed

All the sites you've visited (if you've used Chrome and connected it to your Google account)

Your Google Maps usage history, with full search history

Etc. etc. The tax authorities can ask Google for any document concerning you if they feel it will help them in their investigation7.

Yes. Imagine how much can be learned about you with this information, how much it's an invasion of your privacy.

Let's take the problem of e-mail. Let's say you use Proton Mail instead of Gmail.

Proton Mail is offered by Proton AG, a company based exclusively in Switzerland, by design.

If the tax authorities in your country want to access your e-mails, they can't simply force Proton AG to do so: as the company has no physical presence in your country, they have to go through the Swiss legal system to do so.

This creates additional friction, and forces the taxman to go through a judge when he could normally do without one.

If you're thinking, "OK, but isn't the whole idea to be square? If we have nothing to be ashamed of, why do all this?"

Excellent question. There are several reasons for this:

The concept is to be a smooth square. Having data that can be easily accessed by the IRS, or any other government agency, is the opposite: it makes you a square with rough edges. Lots of rough edges.

Just because you're a square doesn't mean the taxman - or any other government agency - can't try to get under your skin. The French tax authorities, for example, have often in the past provided haphazard interpretations of tax laws - always to their advantage, of course - and often lost in court - after years of litigation8 . If we can reduce the risk of such a waste of time and energy, for virtually no effort on our part, why deprive ourselves?

What's more, if you tell yourself this, it's probably because you come from a democratic, law-abiding state. But not everyone is so lucky: in many countries, government agencies - including the tax authorities - can be instrumental in the fight against political opponents or activists.

And don't forget that many states will be desperate to raise the money they'll be increasingly short of.

Finally, you don't have to do "all that": once you've switched to Proton Mail, using Proton Mail doesn't take you any longer and offers exactly the same functionality as Gmail!

It's the very principle of asymmetrical defense: very little effort on our side, maximum friction on theirs. So why not use it?

As for the other elements, i.e. how to prevent agencies from obtaining your search history, the YouTube videos you've viewed, etc., we'll talk about these in future articles.

Your web host

For your website, it's the same: choose a web host that exists only in a country that, ideally, is not in any of your other flags. And in any case, a country that is not your country of nationality or residence.

And if you really need strong protection, there are a number of hosting companies that specialize in defending freedom of expression, and promise extra protection over conventional hosts, such as NearlyFreeSpeech (USA), SwissMade Host (Switzerland), Orange Network (Iceland, by a Hong Kong-based company), or Abelohost (Netherlands).

There are many others.

Your cloud file service

Instead of using Dropbox, Google Drive, Microsoft One Drive, etc., use Sync.com, based exclusively in Canada, Tresorit, based exclusively in Switzerland, or Proton Drive, also offered by Proton.

These services work in exactly the same way as Dropbox, with the added security of end-to-end encryption (we'll look at the advantages of this type of encryption a little later).

In conclusion

So I've outlined the theory of the method, knowing that I've met many people who practice it, but no one who practices it exactly as the theory would have it: so think of it as a North Star guiding you, rather than a structure to be rigidly applied.

In particular, I don't know anyone who completely separates all their flags.

(In next week's article, we'll look at a number of real-life examples of how to implement the 7 flags)

However, the closer you get to this ideal, the more asymmetrical friction you will have created.

And if you only had one 80/20 thing to take from this strategy, it's this: have nothing in your country of nationality, because that's the one that takes you most for granted, the one that's most motivated to go looking for you, to control you, to get you back into its tax nets one way or another.

A note on the European Union

Even if this is not yet entirely true, the European Union should increasingly be seen as a single flag.

Why is this not entirely true? We examined the difficulties Member States face in having the money and assets of people who owe back taxes seized in other Member States : for the record, only four countries manage to recover more than 10% of the sums claimed.

So there's still a lot of friction preventing smooth collaboration between the countries of the European Union.

However, the trend is clear: more and more harmonization and integration, until one day perhaps becoming the United States of Europe.

So think ahead and consider, as far as possible, the European Union as a single flag.

Coming soon

In the next article, we’ll examine a few real world examples of possible organizations using the seven flags.

Stay tuned ! In the meantime, feel free to follow Disruptive Horizons on X/Twitter & Linkedin, and join the tribe of Intelligent Rebels by subscribing to the newsletter :

And here is the first article of this series :

In which case, a significant proportion of the population of your country of residence speaks this language as a second language, although of course this varies greatly: in Brazil, Japan and Latin America in general, you'll be much safer than in Scandinavia, for example!

"Cyprus details heavy losses for major bank customers", Karolina Tagaris, Reuters, 2013

Directive 2014/59/EU, Bank Recovery and Resolution Directive,

And again, a good CDN (Content Delivery Network) system solves the problem, by creating a copy of your site at various locations around the world, so that each visitor can connect to the copy that's physically closest to them.

With 1.8 billion active users in 2023, "67 Gmail Statistics For 2023", DemandSage.

"Le Fisc tout puissant", Cercle des Fiscalistes, 2020

In France, for example, this right is detailed in Article L81 du Livre des procédures fiscales which, since the LOI n° 2014-1655 du 29 décembre 2014 de finances rectificative pour 2014, has been extended to "All documents relating to the taxpayer's activity". This definition is so broad that the tax authorities can effectively request any document concerning you!

This is true in every country in the world, of course. Do some research for your own country.

You write:

"""

Setting up a business in a country other than your country of residence

Managing it from your country of residence

By declaring it to the tax authorities in your country of residence, and paying taxes as if it were a local company

"But what's the point of doing that?" you might ask.

Good question.

The answer is that it gives you extra protection by creating a legal asymmetrical friction.

"""

Another reason is that you may want to move to other countries, and then it's better if your business is already set-up in a low-tax low-paperwork business-friendly country.

typo: "We examined the difficulties Member States face in having the money and assets of people who owe back taxes seized in other Member States shows you:" -> "We examined the difficulties Member States face in having the money and assets of people who owe back taxes seized in other Member States:"