Is Your Money About to Betray You? The Temptation of Central Bank Digital Currencies

Or 1984 on Amphetamine

"To be governed is to be kept in sight, inspected, spied on, directed, legislated, regulated, parked, indoctrinated, preached to, controlled, esteemed, appreciated, censured, commanded, by beings who have neither title, science nor virtue...

To be governed is to be noted, registered, counted, priced, stamped, tooted, quoted, assessed, patented, licensed, authorized, admonished, prevented, reformed, rectified, corrected in every transaction, in every movement.

It means, under the pretext of public utility and in the name of the general interest, being made to contribute, exercised, held to ransom, exploited, monopolized, concussionné, pressured, mystified, stolen ; then, at the slightest complaint, at the first word of complaint, repressed, amended, vilified, vexed, hunted down, hounded, stunned, disarmed, garroted, imprisoned, shot, machine-gunned, judged, condemned, deported, sacrificed, sold, betrayed, and to top it all, played, fooled, outraged, dishonored. "

Pierre-Joseph Proudhon

Note : After the 14-part series in which we looked at how nation-states are being disrupted by the Internet and globalization, and a 4-part series on why now is the worst time for them, I have concluded that there are two main ways for governments to respond to these disruptions:

Increasingly control what their residents do, via permanent digital surveillance and the use of AI and machine learning (China's way)

Accept that their role will diminish and treat their residents more like customers

In this new series, corresponding to chapter 4 of my forthcoming book, we analyze the (very) slippery slope towards generalized surveillance to which many countries, including the most democratic, are committing themselves.

Here are the 11 articles of the series :

There's an emerging financial phenomenon that's generating much debate and discussion around the world: CBDCs (Central Bank Digital Currencies).

The CBDC project is to create digital currencies, like bitcoin or ethereum, but which will be issued directly by central banks... and central banks mean total state control (or "supra-state" control like the European Union) over their operation and use.

Imagine: your country's central bank creates a digital currency, where every penny can be traced so you know exactly which individual or company's account it's in, and how it's being used.

All of an individual's transactions will thus be known to the state, which will be able to know almost everything about your life.

What's more, if the CBDC is programmable (as most current projects envisage), then the central bank will be able to decide how the money can be spent, in what proportions, with whom, and so on.

If you're thinking this sounds Orwellian and dangerous, you're right. Here are a few possible scenarios that programmable CBDCs will enable:

You try to buy chicken, and your payment is refused, even though you have more than enough money in your account. Reason: you've exceeded your monthly quota for buying food generated by polluting means. Your electronic wallet tells you to eat more vegetables.

You're trying to book plane tickets for a vacation abroad, but your payment is blocked. The government has implemented travel restrictions for citizens with a certain level of carbon emissions, and you've exceeded this limit due to recent business travel. Your CBDC suggests you opt for a local vacation or offset your carbon footprint by supporting ecological projects.

You want to buy a subscription to a magazine whose editorial line is critical of the government. Your payment is refused, because your CBDC is programmed to prevent transactions linked to sources of information not approved by the authorities. Instead, you are advised to subscribe to official media or consult government-approved information sources.

You try to make a donation to a human rights organization, but your CBDC blocks the transaction. Your digital currency's programming informs you that this organization is on a government blacklist and that you cannot support it financially. Instead, it suggests that you contribute to government-approved charities.

You want to buy a new electronic device, but your CBDC refuses payment. The reason is that you have exceeded your quota of electronic purchases for the year, as part of a policy to reduce the consumption of scarce resources and the production of electronic waste. Your digital currency encourages you to repair or recycle your existing devices.

You live in a federal state that has banned abortion. You have the legal right to go to your neighboring state for an abortion, but your home state has created a blacklist of all abortion clinics in your federation, which prevents you from doing any business with a clinic that performs abortions with CBDC units from your state. These are the only ones you own, since you earn your salary in this state.

This scenario also works if you go abroad for an abortion.

And in many other situations: I've heard of citizens of Gulf countries having their bank cards blocked when traveling, after buying alcohol in the West. This kind of possibility will become commonplace with CBDCs.

You're considering enrolling in an online cryptography course, but your CBDC is blocking payment. The government has put restrictions on learning certain skills deemed sensitive to national security. Your digital currency suggests you explore other areas of study, such as artificial intelligence or software development.

You try to buy a ticket to a sporting event, but your CBDC refuses payment. The reason is that you have exceeded your monthly quota for purchasing tickets to entertainment events, in order to promote a more balanced lifestyle between work and leisure. Your CBDC encourages you to participate in government-approved cultural or educational activities.

You want to send money to a friend living abroad, but your CBDC blocks the transaction. The government has introduced strict controls on international money transfers to combat money laundering and terrorist financing. Your digital currency informs you that you need special authorization to carry out this type of transaction, or suggests that you use transfer channels approved by the authorities.

You try to buy an over-the-counter medication, but your CBDC refuses payment. The government has set up a system to monitor drug purchases to prevent abuse and overconsumption. Your digital currency reminds you that you've reached the authorized limit for this month and advises you to consult a healthcare professional to discuss your medical needs.

You try to make normal purchases, but your CBDC refuses payment. The government has detected your participation in an "unauthorized demonstration" and blocked all payments until you "regularize your situation by going to the nearest police station".

Etc.

A gigantic honeypot that will make hackers salivate

Another danger is that all this data will be stored in a gigantic state database, making it an extremely attractive target for hackers, swindlers, thieves and hostile states.

Here are a few examples of what hackers could do with this data:

Identity theft: hackers could use stolen financial information to impersonate citizens, opening new bank accounts, taking out credit or making purchases in their name. Victims of identity theft can suffer serious financial and legal consequences, as well as loss of reputation.

Blackmail and extortion: cybercriminals could exploit stolen financial data to blackmail citizens, threatening to disclose sensitive information such as transactions linked to illegal activities, embarrassing expenses or large debts, unless the victim pays a ransom or agrees to perform certain actions for the criminals, such as espionage.

Intrusive targeted advertising: companies could use stolen financial information to create detailed profiles of people's consumption habits and preferences, and then send them very precise targeted advertising. This could lead to a violation of privacy and increased commercial surveillance.

When your own money doesn't belong to you

The important thing to remember is that with CBDCs, your money doesn't really belong to you: it's the government that has "master access" and can ultimately decide how you use it.

And the mere possibility that a government might have this power is terrifying, even if it's democratic, even if it swears up and down that it'll never use it.

Countless, countless examples in history - and I hope this series has convinced you of this - show that when a state has a new means of controlling its population, just like Sauron's One Ring, it can't help but use it, even if it means doing so behind the scenes if democratic control processes are a little too cumbersome. The Snowden revelations are very clear on this point.

And no democratic government is safe from a populist being elected on the strength of unachievable promises, only to turn his country into a dictatorship, as Napoleon III, Hitler, Mussolini, Franco, Salazar and many, many others have done throughout history.

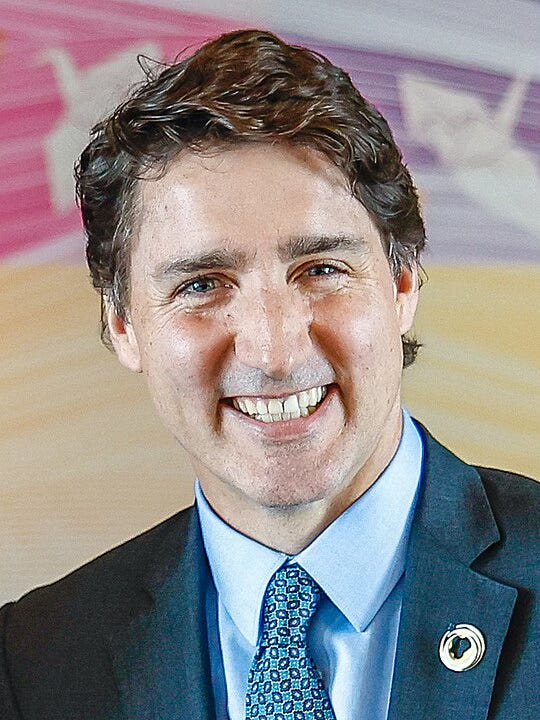

The recent sad example in Canada

We already have an example of a democratic country censoring a protest movement using currency as a weapon.

In 2022, the "Freedom Convoy" began, a Canadian protest movement opposing compulsory vaccination for covid-19 and related restrictions. The movement included between 120 and 230 trucks and several hundred cars, which occupied and blocked downtown Ottawa (Canada's capital), declaring that they would not leave until all restrictions and obligations related to the epidemic were repealed.

The blockade lasted five weeks, without the Canadian government coming up with a solution - moving so many trucks in the middle of a Canadian winter was a challenge, not to mention the fact that many tugboats refused to do so, often in a mixture of fear and solidarity with the movement.

Finally, an irate Prime Minister Justin Trudeau invoked the Emergency Measures Act, a never-before-used measure dating back to 1988 and designed for times of war and major disasters, giving police and government extraordinary powers: "My Deputy Prime Minister Chrystia Freeland said that under this law, protesters' trucks could be seized, their bank accounts frozen and their vehicle insurance suspended."

And that's exactly what happened: Canadian banks were ordered to freeze the bank accounts of individuals and companies suspected of participating in the protest, and were protected from civil liability in enforcing the order1 .

Within a few days, at least 76 bank accounts linked to the protesters and totalling 3.2 million Canadian dollars were frozen2 .

In the end, this episode was short-lived, for although the measure was passed in the House of Commons (Canada's lower house), it was immediately contested by several political parties and personalities, and by civil rights associations3 , triggering a stormy debate in the Senate that dragged on for several days, even though the government was expecting a quick vote4 .

Under attack from all sides and facing a possible negative vote from the Senate, Justin Trudeau revoked the emergency declaration.

So it was a brief episode, much criticized, but one that shows that even in the most democratic and reputable countries like Canada, it's very hard for governments to resist the temptation of the power of the Ring. And the CBDC will give them a ring on steroids.

Note also that in this case, the most fragile protesters were the mono-country ones: those with bank accounts in the US or another country were much less affected, as were those using cryptos (Bitcoin was used during this episode to get around account freezes ).5

As for all those who live in a state that is already fundamentally undemocratic, God help the dissidents.

Imagine what Hitler would have done with such power, how he could have further discriminated against Jews: "Your payment has been refused, as it is now forbidden to trade with Jewish people".

Imagine how it will be possible to discriminate between citizens on the basis of their income, their spending, their religious or political affiliation, and so on.

In these dictatorial countries, the main way of escaping this will probably be through the use of cryptos.

And... in democratic countries too. So take an interest in cryptos in any case.

Coming soon

In the next article, we’ll take a look at how states are starting to use AI and machine learning to take their surveillance capabilities to the next level.

Stay tuned ! In the meantime, feel free to follow Disruptive Horizons on Twitter or Linkedin, and join the tribe of Intelligent Rebels by subscribing to the newsletter :

Other articles in the series

James Bradshaw, "Emergencies Act will expand powers of Canadian banks to freeze accounts, halt funds", The Globe And Mail, 2022.

"CCLA warns normalizing emergency legislation threatens democracy, civil liberties", Global News, 2022.

Catherine Lévesque, "Senate growing frustrated by pressure to rubber stamp Emergencies Act", National Post, 2022.

David Fraser, "Digital currency donations for Freedom Convoy evading seizure by authorities", CBC News, 2022.