How To Live Tax Free in the European Union

In 6 Surprising Countries

Note : This article is the 4th in a series on how to significantly reduce your tax bill and maximize your freedom by moving abroad. Here are the first articles in the series :

Yes, it is possible to live in the European Union and still benefit from very low taxation! Let's take a look at some of the most popular options.

Greece

This country, also renowned for its sunny climate, culture, food... and high taxes, offers two very interesting regimes.

1. The non-domiciled investor regime

This allows people who invest 500,000 euros in Greek assets to pay a flat-rate tax of 100,000 euros a year, regardless of their income or wealth, for up to fifteen years.

The most common asset classes are eligible, and the individual can invest through a company.

The amount may comprise up to three separate investments, and the applicant may conclude the investment(s) up to three years after applying for the status.

Family members can also benefit from this scheme, for an additional tax allowance of €20,000 per adult family member per tax year.

Income from abroad is fully tax-exempt, as are assets held abroad. Income from Greece is subject to the usual Greek tax rates.

To qualify, you must not have been a Greek tax resident for seven of the eight years prior to transferring your tax residence to Greece.

Those opting for this regime are not obliged to declare income received outside Greece, and are not subject to any tax on foreign assets.

It's a scheme similar to the Italian one we saw in this article, aimed at those who already have a certain income: if you earn 200,000 euros a year, your rate will be 50% and that won't be very attractive, whereas if you earn a million a year, the rate will be 10% and therefore very favorable.

However, the 500,000 euro pre-investment requirement is a bit of a killer, especially when compared with other options available in Europe.

2. Non-domicile regime for pensioners

The Greek non-domicile regime for pensioners1 offers a flat-rate tax of 7% on pensions and other income such as dividends, interest and capital gains realized from a foreign source, for up to fifteen years.

If you have already paid tax on foreign income in another country, you can claim tax credits and deductions against the 7% in Greece.

To benefit from these, you must have a pension or pension-like income from a foreign source. This may include payments made under public or private pension schemes, but also dividends, interest, annuities, capital gains, etc.

You must also not have been considered a tax resident in Greece for five of the six years preceding your move, and come from a country that has an active tax administrative cooperation agreement or double taxation treaty with Greece.

This is a very attractive regime, not only for pensioners, but also for annuitants and other passive income earners.

Italy

As detailed in this article.

Malta

This small country south of Sicily offers two very interesting tax regimes:

The non-domiciled regime

This distinguishes residence from domiciliation, which is typically your country of origin2.

Being a non-domiciled resident allows you to live in Malta, to have tax residence there, and to pay tax only on the income you generate from Maltese sources, or from income generated abroad that you bring back to Malta.

Specifically, as a "non-dom" you will pay :

0% tax on foreign income not transferred to Malta

15% on foreign income transferred to Malta (which is a very low rate)

0% tax on capital gains made abroad, whether or not transferred to Malta

0% inheritance tax

You must pay a minimum tax of 5,000 euros each year. If you set things up properly, this could be the only direct tax you pay in Malta.

So, if you have a company in a low-tax country, with at least one local manager, you can have an extremely low-tax setup, while still living in the European Union.

Note again that, if you manage this foreign company from Malta, this will create a permanent establishment which will be domiciled for tax purposes in Malta, so that 1) this company will pay corporation tax in Malta (which is not very high, as we shall see), and above all 2) this income will be Maltese-sourced, and therefore not eligible for the exemptions of the non-dom regime. But then again, some countries check this, and others don't really care, and Malta is a priori in the latter category.

There is no time limit for this regime.

An effective corporate income tax rate of 5%.

Malta's official corporate tax rate is 35%, making it the highest in Europe... except that profit distributed in the form of dividends is eligible for a refund of 6/7 of this tax.

So if you distribute all your profits as dividends, you'll pay 5% corporation tax, the lowest rate in Europe.

There is no time limit for this regime.

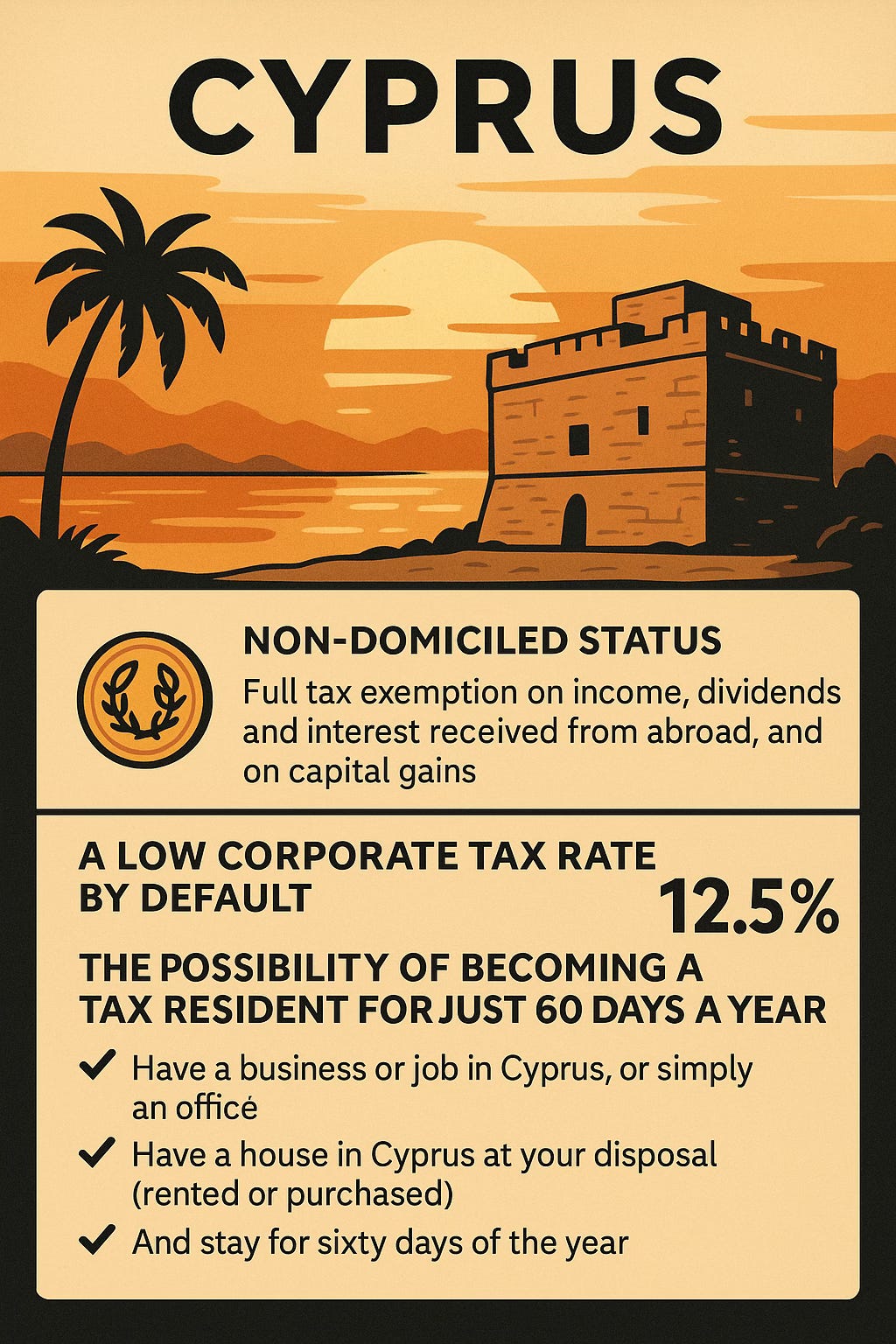

Cyprus

This island of Greek culture (at least in the part not occupied by Turkey) offers a Mediterranean climate, 340 days of sunshine a year, excellent cuisine, mountains and sea, and... particularly advantageous tax conditions.

Non-domiciled status

Making the same distinction between residence and domicile as Malta3 , this regime allows full tax exemption on income, dividends and interest received from abroad, as well as on capital gains, except on property sold in Cyprus.

This regime can be used for seventeen years after moving to Cyprus.

A low corporate tax rate by default

at 12.5%.

The possibility of becoming a tax resident for just 60 days a year.

This is particularly interesting for digital nomads who wish to benefit from Cyprus' non-dom regime, while still having a tax residence in a European Union country.

To qualify, you must meet the following conditions:

Have a business or job in Cyprus, or simply an office

Have a house in Cyprus at your disposal (rented or purchased)

And stay for sixty days of the year.

The United Kingdom

In 2024, the United Kingdom announced the end of its "non-domiciliation" system, in existence since 1799, which allowed many foreigners to be completely exempt from tax on foreign-source income, as long as this income remained outside the country.

Is this a counter-example to the trend for countries to offer different tax systems for foreigners?

Not really, no. Instead, the English government has set up a system that is superior to the non-dom in many respects:

To benefit from it, you can't have been a UK tax resident for the last ten years. This rule applies to foreigners as well as British citizens.

For the first four years of your UK residency, you will not pay UK tax on your foreign income and capital gains, and :

You can bring this money into the UK at no extra cost.

You won't pay tax on money in non-resident trusts.

You will continue to pay tax on UK-source income and capital gains.

We can see that you can end up with a 0% company with the right organization, for example an American LLC managed by a manager living in a country without CFC rules (more on this below), or just a low-tax company by putting it in Dubai with a local manager.

Poland

A very interesting regime is available for people transferring their tax residence to Poland: they can choose the option of paying a lump sum of PLN 200,000 per year (around 47,000 euros at the time of writing), regardless of the level of their foreign income and without having to declare to the tax authorities the sources of this income, its exact amount and the country in which it was obtained.

To qualify, you need to spend at least PLN 100,000 (just under €24,000) a year on one of the categories of social expenditure provided for (e.g. scientific development).

This means a flat-rate tax of around 71,000 euros a year, which, depending on how much you earn, can be very attractive: with an annual income of 500,000 euros, you're taxed at just 14%.

Coming Soon :

In the next article, we’ll explore how to legally pay low taxes in the Americas, Africa, and Asia — three regions full of surprising, high-potential jurisdictions for digital nomads, entrepreneurs, and investors.

From Costa Rica’s territorial tax system to Mauritius’ tropical low-tax paradise, and Dubai’s unmatched value-for-money governance, we’ll look at how different states position themselves in the global jurisdictional market — and how you can benefit from it.

If you think the EU offers creative solutions… wait until you see what the rest of the world has to offer.

Stay tuned ! In the meantime, feel free to follow Disruptive Horizons on X/Twitter & Linkedin, and join the tribe of Intelligent Rebels by subscribing to the newsletter :

And here are the first articles of this series :

In a broad definition, as it includes all those earning passive income, such as pensions, but not only.

It has its origins in the British system, Malta having been under British rule from 1814 to 1964. More on this below.