How to Pay Less Tax While Improving Your Contribution to Society

What Politicians Won’t Tell You About Inequality

Note : This article is the 3rd in a series on how to significantly reduce your tax bill and maximize your freedom by moving abroad. Here are the first articles in the series :

It's perfectly possible to take advantage of the jurisdictional market while taking the fight against inequality as a criterion.

But how?

Let's take the example of Jean, a French digital nomad who wants to leave France, partly to pay less tax, but who is keen to go to a country that doesn't have 0% tax, and which practices a good form of wealth distribution so as to reduce inequalities.

He starts by looking at the Tax Foundation's index to determine which countries are more tax-competitive than France:

Well, the good news is that just about every OECD country is more tax-competitive than France!

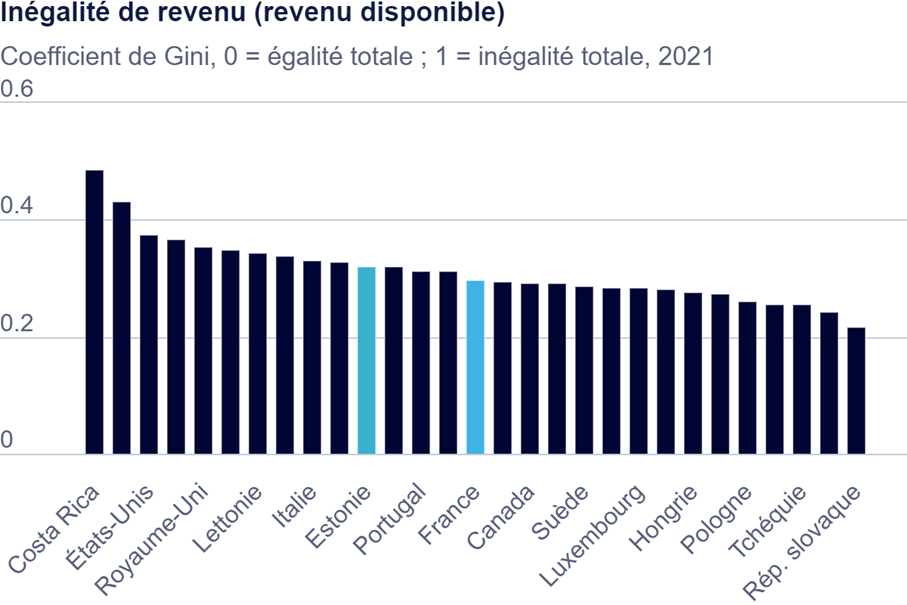

Then, to determine the degree of equality of the countries he's considering, our digital nomad consults the Gini coefficient of these countries.

The Gini coefficient is a measure of the inequality of income or wealth in a population. It varies between 0 and 1:

0 means perfect equality (everyone has the same income).

1 means total inequality (one person has everything).

Jean then realizes something extraordinary:

Estonia, the OECD's 1stmost tax-competitive country, has a better Gini coefficient than Italy, which is at the very bottom of the ranking!

And Estonia's Gini coefficient is almost identical to France's!

Wow. Jean now knows that he can not only drastically reduce his taxes, but also increase the efficiency of their use: a country with a similar Gini coefficient to another, but with fewer taxes, is more efficient in its use of taxation to redistribute wealth.

Conclusion - The recipe for paying less tax while improving your contribution to society

Look at which countries are more tax-efficient than yours (using the Tax Foundation's ranking, for example, but also the percentage of tax revenue in GDP shared by the OECD)

Then simulate the amount of taxes you would pay in your target country

By moving to countries that have 1) a better Gini coefficient than yours, and 2) lower taxes, you can contribute to a better redistribution system WHILE paying less tax

Coming Soon :

In the next article, we’ll explore how you can live within the European Union while benefiting from remarkably low taxation. From Greece’s flat tax for wealthy investors to Malta’s non-dom status, Cyprus’ flexible 60-day residency, and Poland’s lump-sum tax regime, you’ll discover how these countries are rolling out the red carpet for international residents — without sacrificing your financial freedom.

Whether you're a retiree, entrepreneur, or digital nomad, these legal frameworks could change everything.

Stay tuned ! In the meantime, feel free to follow Disruptive Horizons on X/Twitter & Linkedin, and join the tribe of Intelligent Rebels by subscribing to the newsletter :

Estonia and Poland are success stories that we ought to be talking more about.

Estonia’s tax system is about as close to ideal as one can find in the real world:

A simple flat VAT

Corporate tax only on distributed profits

Can file in five minutes online

It should not be surprising then that Estonia is also one of the fastest-growing economies on Earth. Imagine how much growth the US could unlock if it simplified its tax code?

Using Estonia’s Gini vs Italy’s as proof that flat taxes and low rates create equality is a textbook case of confusing correlation with causation. Estonia’s young economy is still in productivity catch-up. Italy’s is weighed down by decades of credit-driven inequality and Eurozone debt. Taxes tweak the surface. Credit and productivity drive the core of inequality.