How KYC and AML are destroying the world

The road to hell is paved with good intentions

Have you ever been surprised by a request from your bank, demanding information about an innocent transfer you made, asking you about such important things as where the funds came from, where they were going, the reason for the transfer, your last tax return, and the size of your socks?

“Oh dear”, you exclaimed, "but does my money belong to me if I have to justify its use at every turn, even for trivial matters?”

Fear not, dear friend, for it all makes sense. Let me explain it to you, for once, through a fairy tale...

Once upon a time, in a world plagued by conflict, corruption, crime, tax evasion and power struggles, there were two heroes called KYC and AML, born to protect the realm of financial transactions.

Their mission was a noble one: to prevent fraud, money laundering and the financing of terrorism, in order to guarantee a safer, more transparent world for all.The first hero, AML, or Anti-Money Laundering, appeared in 1989, when world leaders realized that money laundering and terrorist financing were threatening global peace and security.

And so, in a snow-capped mountain meeting, a group of countries created the FATF, or Financial Action Task Force. The FATF's mission was to establish international standards to combat these scourges, and to monitor their implementation.

The second hero, KYC, or "Know Your Customer", was born in the 1990s and 2000s, in response to growing concerns about financial crime. Its aim was to ensure that banks and financial institutions knew their customers well before granting them financial services. Institutions were required to check the identity of their customers, as well as their background and the nature of their activities, to ensure that they did not pose a risk to the financial system.

Over the years, KYC and AML have evolved and strengthened with the adoption of new laws and regulations. Banks and financial institutions were required to put in place strict policies and procedures to ensure they met these standards, and regulatory bodies were created to oversee them.

All players in the financial world had to learn to work together to enforce KYC and AML rules, and the heroes were able to extend their influence through international cooperation. As the realm of financial transactions became safer and more transparent, citizens around the world could sleep more peacefully, knowing that the threats of fraud, money laundering and terrorist financing were under control.

And so, our KYC and AML heroes continue to watch over the world of financial transactions, fighting tirelessly to maintain the integrity and security of our economic system. And their impact on our world is undeniably magical.

A wonderful fairy tale, and an example of how regulations can bring value to the world, making society safer and more transparent for everyone, isn't it?

Oh boy. Fasten your seatbelts, it's gonna get bumpy.

And there's nothing like a true story to make you understand the problem.

How to get your account closed after 43 years of use in 1 easy step

June 2023. Nigel Farage, a former politician with controversial views, who was notably leader of the Brexit party, and therefore a 1er leading figure in the Brexit campaign, announces on his Twitter account that his bank has decided to close all his accounts (personal and business) without warning, without explaining why, and without any possibility of recourse, after having been a customer for 43 years (yes).

He said that he may have been the victim of "blatant corporate bias" because of his Brexit campaign, or that he had fallen foul of the "politically exposed persons" rules, designed to reduce banks' exposure to corruption and money laundering1.

He shared in an article published the next day2 that he tried to open an account at 7 different banks, all of which refused to open him an account, again apparently because he is a "politically exposed person". This figure rose to 9 a few days later3.

What's surprising, though, is that many politicians need to open accounts, and most don't get turned down like that.

On the other hand, it seems that more and more accounts are being closed for political or image reasons, or simply because management does not agree with the customer's views4.

Now, Nigel Farage's political views may not be your cup of tea - they're not really mine either, to tell you the truth - but it's clear that seeing someone debarred for dubious reasons that are probably political should alarm us all: sooner or later, it could backfire on your favorite politician - or even you.

As I write this, the case is still ongoing, and Jeremy Hunt, the UK's Chancellor of the Exchequer (equivalent of the US Secretary of the Treasury, or a minister of finance) says he is "deeply concerned" about the possibility of banks closing accounts for political reasons. It was revealed later that he also got a bank account denied.

Update : it was later confirmed that the account was indeed closed for political reasons. The City Minister also summoned Britain’s biggest banks to discuss this problem5, and the Prime Minister Rishi Sunak himself commented the situation. All in all, it is, let’s be clear, quite a scandal.

This whole affair raises two main questions:

What allows a bank to close the account of a customer who has been working with them for 43 years, without explanation or possibility of appeal?

Why can so many banks refuse to open an account?

First of all, a bank, as a private company, is generally free to choose with whom it works (although some countries, such as France, may designate a bank as having to accept a customer if he or she is unable to open an account).

But, of course, banks have a vested interest in accepting customers rather than refusing them... after all, their raison d'être (and business model) is based on making money by working with them.

And, controversial as Nigel Farage's political views are, they are unlikely to be so controversial that all the banks refuse to work with him for this reason.

In fact, it's probably a mix of political and regulatory reasons.

Because, as we shall see, the reason why 1) many banks are reluctant to deal with special profiles, and 2) why they can refuse or close accounts without giving any reasons, and can therefore discriminate very easily, is largely due to our two great heroes of the day, KYC and AML.

How is this possible? That's what we're going to find out.

But first, do our two heroes manage to catch the criminals?

Numerous6 studies7 scientific8 focused9 on10 the11 effectiveness12 of13 AML14 and KYC.

Here's a summary of what they found15 :

Volume of criminal funds identified

It is estimated that these two policies enable the authorities to recover 0.05% of criminal funds. Yes, yes, you read that right: 99.95% of criminal and terrorist financial proceeds fall through the cracks of AML and KYC.

Since, unfortunately, there is no real policy for measuring the effectiveness of AML and KYC (which is absurd, as we shall see below), estimates vary, and some are more optimistic.

For example, a major European study16 examined criminal revenues from various illicit activities, such as drug sales, estimating that these activities generate at least 110 billion euros every year.

Europol reports that European authorities only confiscate around 1.2 billion euros worth of illicit funds each year.

This suggests that the success rate of anti-money laundering efforts is only 1.1%, a more optimistic figure than 0.05%... but still incredibly low.

It should be noted that this analysis has excluded many other illegal activities such as human trafficking, extortion, illegal gambling and other types of fraud, and that if the figures for these activities are taken into account, the rate of illegal money actually confiscated must be well below 1%.

According to 2009 data, the UN17, with the help of the US State Department, estimated that the global success rate of money laundering controls was just 0.2%. However, the confiscation rate could be as low as 0.07%.

That's better than 0.05%, isn't it? We can congratulate the people in charge of applying AML and KYC for these incredible performances.

And of course, this is without taking into account the fact that many of these confiscations of criminal assets often occur independently of AML/KYC regulations, and often result from traditional law enforcement methods, such as drug trafficking investigations, which uncover assets purchased with criminal funds.

Empirical research in New Zealand has shown that conventional methods were responsible for 80% of confiscations involving lawyers, accountants and estate agents who facilitated illegal real estate transactions.

And that only 20% of confiscations come from the application of KYC/AML procedures18.

So if this ratio is applicable to the rest of the world's seizures, you can divide by five the figures given above... which gives a success rate of between 0.01% of seized criminal financial assets (pessimistic rate) and 0.22% (optimistic rate!).

Lack of measurement of real results and perverse effects

In fact, elements of measurement that are extremely common in public policy, such as a cost-benefit analysis of measures, is "surprisingly rare in anti-money laundering discourse (reflecting a persistent reluctance to consider costs or show results in terms of the impact of policy intervention)"19.

“A cost-benefit analysis of measures, is surprisingly rare in anti-money laundering discourse (reflecting a persistent reluctance to consider costs or show results in terms of the impact of policy intervention)”

The aim of both policies was to use cash flows to detect and prevent serious crime, but curiously no crime reduction or prevention measures were developed to measure success20.

Furthermore, the FATF's "high-level objective" (to protect financial systems and the wider economy from the perceived threats of money laundering) lacks specificity and measurability. It is so general as to be virtually meaningless as a measure of effectiveness21.

In fact, most of the players involved in both policies focus primarily on the compliance of their actions with the standards, rather than the results, even though, as we shall see here, the results of these policies are absolutely disastrous, even though the FATF regularly asks these players to focus on the results (but without questioning the policies it advocates).

"In the field of anti-money laundering [...] persistent failure is marked by erroneous and disputed evidence of "what works and why".

[...] individual successes mask the reality of overall policy failure.

Relevant data is also scarce and obscured by prevailing belief systems and narratives.

For example, the perceived inability of banks and regulators to implement existing rules "correctly" or "fully" is often blamed, despite evidence to the contrary22".

Many stakeholders prefer to follow the official discourse rather than question it, because the incentives set up by the system have perverse effects: an ecosystem of companies and professionals depends on the current paradigm to earn billions in commissions and fees.

And banks, anxious to avoid sanctions and regulatory problems, adopt anti-money laundering programs dictated by political norms, and it doesn't matter whether these laws achieve their objectives or not, the main thing is to be able to show a clean slate in the event of an audit, to avoid fines (substantial, as we shall see) and reputational damage.

Arbitrarily closed accounts and an open door to discrimination

One of the other perverse incentives created by this system is that many banks are closing more and more accounts at the drop of a hat, without ever explaining why, exposing tens of thousands of people to what can be considerable trouble without the slightest logical reason : Nigel Farage's example is just one of many, and no, Britain is far from being the only country affected, as shown by various23 articles24 from25 newspapers26 (not to mention, of course, totalitarian countries, where this kind of measure is multiplying27).

Because if an account brings in a few hundred or thousand dollars a year, and can cost tens of thousands of dollars in fines or more, the calculation is quickly made, and the bank prefers to err on the side of safety.

Because KYC and AML are also an open door to all kinds of discrimination: since the department in charge of applying them in the bank is generally independent, and isolated from other departments in order to preserve its autonomy, it can take any decision without ever explaining it to anyone outside the department. In such a vacuum, bias, racism and other forms of discrimination have a field day!

This happened to a friend of mine, whom we'll call Jean: Jean wanted to set up an account with a European bank that had been highly recommended to him by two of his friends. Jean had exactly the same profile as his friends: entrepreneur in exactly the same field, with roughly the same personal profile. And yet, he was refused an account, even though the red carpet had been rolled out for his friends.

The reason? Who knows, since the service didn't give the reason for his refusal... But when he compared his situation with that of his friends, he had to face the facts: the only significant difference was that he had a non-European passport, from a country little liked (but not facing sanctions of any kind) by the country in which he wanted to open a bank account. This had all the appearance of discrimination... But how could you prove it with such a process?

As for costs... hang on!

In 2009, the estimated annual cost of compliance with AML and KYC regulations in four EU countries (France, Germany, Italy and the Netherlands) amounted to $81.4 billion28.

With these countries accounting for 52.2% of the European Union's GDP, a simple extrapolation suggests that compliance costs in the EU amounted to $156 billion (€144 billion).

And yet, let me remind you, Europol estimates that European authorities only confiscate around 1.2 billion euros worth of illicit funds each year.

As a result, the direct costs of implementing these policies are more than 100 times higher than their benefits!

The same study looked at other countries around the world, adding Switzerland, the USA and South Africa for a total cost of $110.85 billion.

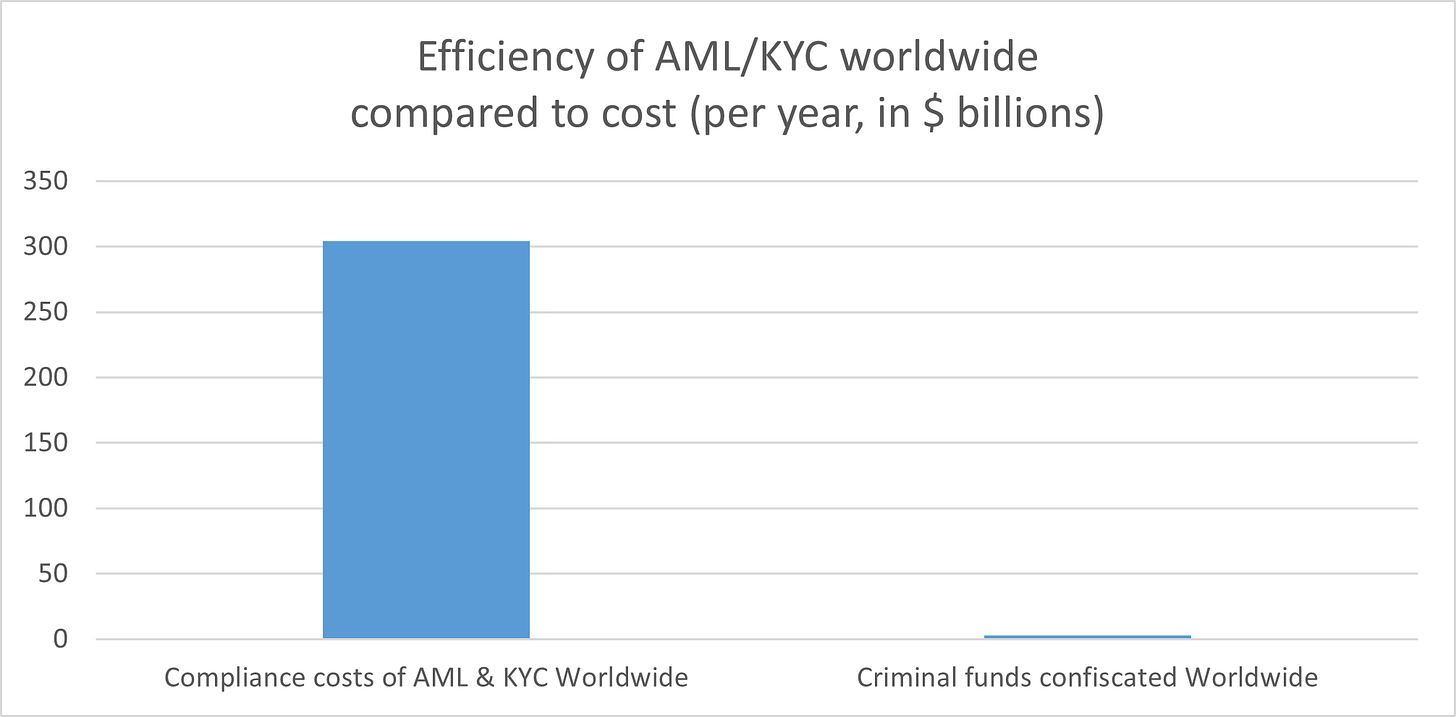

At the time, these countries accounted for 36.5% of global GDP29, so a simple extrapolation suggests global compliance costs of the order of $304 billion, or 0.38% of global GDP, while the authorities manage to seize around $3 billion a year in criminal funds worldwide (!).

So once again, the direct cost is more than 100 times greater than the funds recovered!

Not to mention, of course, the indirect costs to the company due to the enormous friction created for customers, who lose time and productivity, when they don't simply have their accounts closed without explanation, as mentioned above.

Also, the costs of the 80 or so international bodies and thousands of government agencies in 205 countries and jurisdictions involved in the fight against money laundering are unknown, but are probably very high, running into billions of dollars worldwide. Just think of all those civil servants and public servants who are paid to blow hot air at taxpayers' expense when they think they're doing something useful.

And these regulations are fuelling a massive industry of law firms, lawyers and other startups, all jostling to come up with the most effective solutions for stirring up the regulatory wind, in return for checks worth collectively billions of dollars.

For example, a major consultancy firm, in 1st line with the tools required to implement these regulations, stated that they had created "a dynamic market for consulting services and technology solutions [...] Demand has generated a myriad of offers from existing and new suppliers [...]. Regulatory technology startups have attracted billions of dollars in investment in recent years30[...].

The same firm states in its report that "Most anti-money laundering practitioners respond that they focus on compliance and 'ticking boxes' rather than investigating leads and intercepting prohibited movements of funds".

Even though the false positive rate is so high that "only one or two transaction monitoring alerts out of every hundred are usually acted upon"...

Only one or two transaction monitoring alerts out of every hundred are usually acted upon

And that "the overwhelming majority of productive alerts - those that lead to investigations - originate from inquiries from the police themselves", rather than through KYC and AML procedures.

The cost to banks is also astronomical: penalties for non-compliance with anti-money laundering regulations amounted to $4.3 billion in 2018, $8.1 billion in 201931 and an outright $10.4 billion in 202032, while, let me remind you, the authorities recover only $3 billion a year worldwide from criminals (!).

The banks therefore pay more than the authorities manage to recover, even as they try to apply ineffective and useless regulations to billions of transactions every year...

And that they are not paid to perform this task, which is not their job, but have to pay their government for this privilege!

Modern servitude

In general, when a government forces companies to work for it for free, and even fines them if they don't do their job properly, it's considered a form of servitude.

How would you react if your government forced you to work for them for free, threatening to fine you if you didn't do a good job?

Some banks have tried to solve the problem by dramatically increasing the number of people in charge of AML and KYC, reaching up to 15% of total staff.

The result? According to Shane Riedel, one of the world's leading experts on the subject, and former head of regulatory compliance at Standard Chartered Bank: "[In 2020 and 2021], we've seen a huge increase in financial crime, and despite all this investment, we're still getting mediocre results. Throwing money at the problem will not solve it"33.

And if you're thinking that it's not so bad because "the rich banks are paying", remember that these costs are necessarily passed on to their customers: in the end, you're the one footing the bill.

And you foot the bill in your bank's charges, but also in your taxes, to support all those useless agencies and organizations, and also because you're considered a criminal until proven otherwise.

What's the real impact on crime?

Here's a question that seems to be one of the blind spots for almost everyone in the industry, whether they're in the thick of it or just motivated not to ask it, given the big cheques that await them if they continue to turn a blind eye:

If AML and KYC are so effective, has crime really fallen since they were introduced?

For example, one of the main targets of these regulations is drug trafficking: AML especially was designed to prevent money from drugs reentering the system, because the reasoning was that if criminals can't use their money, then they'll lose the incentive to sell drugs.

So have we seen a decline in the availability of drugs in the West between the 1980s (before the advent of these regulations) and today?

This is easy enough to verify, by examining the numerous data published on the subject.

Here are the figures given by the UN in their various annual reports from 2000 to 2022 on drugs34 :

Number of people who have used drugs in the last 12 months :

2001 : 185 million people aged 15 to 64, i.e. 4.7% of the population concerned35

2010 : 226 million people, or 5%36

2020 : 284 million people, or 5.6% of the population37

2030 : an increase of 11% is projected, which would mean more than 319 million people per year affected38

It's a bad start: we're seeing a clear increase in the number of drug users.

Let's look at some other data.

Percentage of American high school students who have used illegal drugs at least once in their lives39

1990 : 47,9%

2000 : 54%

2010 : 48,2%

2019 (chosen because COVID somewhat disrupted measurements): 47.4%.

Here we see a slight improvement since 2000, but stagnation since 1990.

Number of deaths linked to illegal drug use worldwide40 :

Number of deaths directly attributable to drug use :

1990 : 56 144

2019 : 128 083

A 228.13% increase

Number of deaths indirectly due to drug use :

1990 : 235 888

2019 : 494 492

A 209.63% increase

So...

“It’s been over 20 years since the USA PATRIOT Act became law. Its impact on financial crime is debatable. Millions of SARs sit in FinCEN databases, and financial institutions have collectively spent trillions of dollars implementing and running AML programs. Yet, crime continues to rise, criminal organizations grow, and illicit profits soar.”

David Caruso41

All in all, we can see that all these figures show a clear trend of increasing drug use, and therefore production and sales.

And everyone can do a field study for themselves: if you're in at least a medium-sized Western city, how long would it take you to find someone to supply you with cannabis (if it's illegal where you live), or any other drug?

The truth is that it's extremely easy for anyone to obtain drugs in the West, and that a significant percentage of the population has tested them at least once in their lives42 : it's an open secret.

However, if AML and KYC were effective, drug traffickers would no longer be able to use their money, thus removing their motivation: it wouldn't be so easy to find drugs.

But it's easy. How do you explain this?

Are drug traffickers benefactors of humanity who like to work for free?

The truth, as all the figures we've just seen show, is that they continue to sell drugs because they always manage to launder and use the money they earn illegally. Otherwise they'd stop. QED.

KYC and AML are therefore unnecessary.

Of course, you could argue that without them, the problem would be much worse.

Perhaps. But it's also a very easy argument to use: "ok chief, we haven't improved the results, but thanks to us they haven't dropped catastrophically either, that shows our efficiency!"

How can you prove or disprove this sentence?

It's virtually impossible - a sign in many cases of the recursive reasoning of those who don't want to be confronted with reality.

And in any case, beyond the figures on drug trafficking in general, the numerous studies cited above all show the extremely limited effectiveness of these regulations, with once again less than 1% of criminal funds seized.

Beyond that, there's a huge problem with KYC and AML, yet very little discussed.

Guilty until proven innocent

The concept of presumption of innocence is a fundamental principle of law and a cornerstone of democratic societies.

Article 11 of the UN Universal Declaration of Human Rights43 stipulates: "Everyone charged with a penal offence has the right to be presumed innocent until proved guilty according to law in a public trial at which he has had all the guarantees necessary for his defence.”

This is very important for the following reasons:

Burden of proof: This concept places the burden of proof on the prosecution, i.e. it is up to the prosecution to prove the guilt of the accused, not the accused to prove his or her innocence. This protects citizens' rights and ensures that the government and prosecutors respect the rules of procedure.

Prevention of abuse of power: The presumption of innocence helps prevent abuse of power by the authorities and the judicial system. It prevents people from being convicted on the basis of rumors, prejudice or unfounded accusations, and ensures that the judicial system remains transparent and accountable.

Confidence in the judicial system: A judicial system that respects the presumption of innocence is more likely to be perceived as fair and equitable by citizens, thereby strengthening public confidence in democratic institutions.

Minimizing miscarriages of justice: By requiring solid evidence to convict a person, the presumption of innocence reduces the risk of miscarriages of justice and unjust convictions.

The problem is that KYC/AML procedures do exactly the opposite: they consider you guilty until proven innocent.

If a bank finds one of your transactions suspicious, it's up to you to prove that it's legitimate, not the bank or the authorities.

You are obliged to give all documents, including the most personal ones such as your tax return, to the banks that request them, to prove that you are not a criminal, instead of the banks and the authorities having to prove that you are a criminal.

In some cases, the authorities may freeze funds or seize assets belonging to you, as a "precaution", without you even needing to be found guilty of anything. It is then up to you to prove your innocence in order to recover your funds and assets.

KYC and AML procedures can sometimes lead to profiling and discrimination practices, where certain individuals or groups are considered to be at greater risk of illegal activity because of their nationality, ethnic origin or socio-economic status. When this happens, it is clearly a presumption of guilt and a violation of the principle of equality before the law.

The New York Times article I have already quoted44 mentions that the probable reason for the closure of the account of one of the bank's customers is that he regularly sent money to his relatives in Pakistan: this customer is therefore presumed guilty, and has no concrete recourse against the closure of his bank account, apart from opening one in another bank which will probably apply the same kind of arbitrary rules.

KYC and AML have led to an explosion in the number of companies that are obliged to request and store identifying data from their customers, making so many targets for hackers, who can then use this data for various crimes, such as identity theft. For example:

US bank JP Morgan Chase was the victim of a cyberattack in 2014, which compromised the contact data of more than 76 million households and 7 million small businesses45.

One of the largest data breaches in history occurred at Equifax, a US credit reporting agency, in 2017. The personal information of 147.9 million Americans, 15.2 million Britons and around 19,000 Canadians was compromised, including names, social security numbers, dates of birth and addresses46.

Desjardins, a Canadian financial cooperative (bank), suffered a data breach affecting around 9.7 million members in 2019. Personal information, such as names, dates of birth, social insurance numbers and addresses, was stolen by a malicious employee47.

So, by wanting to reduce the number of crimes, we're opening a Pandora's box that allows many more crimes to be committed.

And don't put words in my mouth: if someone is suspected, on the basis of clear evidence, of being a drug trafficker or a terrorist, I see no problem with an investigation that delves into his accounts to determine the truth, provided that a judge has authorized the procedure on the basis of this evidence.

The suspect will lose some of his privacy, but it's a price to pay that seems reasonable and limited for society to be able to function, since we're talking about an individual who is under suspicion on the basis of tangible elements.

But mass surveillance, where everyone is considered guilty until proven innocent, runs counter to this principle of balance.

In conclusion : the modern soothsayers

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

―Upton Sinclair

So here we have the example of an entire industry, worth billions of dollars billed each year in services, fees and other charges, coupled with 80 international organizations and hundreds of public agencies paid directly by taxpayers, occupying tens of thousands of individuals who have the same role as the soothsayers who read the future in the entrails of animals in the days of the Roman Empire: they are all hot air, hiding behind complex words their total inability to prove that what they are doing is really useful, triumphantly showing off the few victories they have achieved here and there, mostly by luck, when the statistics show implacably how completely off the mark they are.

What's more, they feed heavy regulation that "clogs the arteries of civilization48" and imposes a huge cost on society, both directly, via taxes consumed in pure waste, and banking services billed more expensively than they should, and indirectly, by deviating from one of the most sacred principles of democracies, by introducing arbitrariness that leads to inequalities and dramatic situations, by heavily invading people's privacy for nothing, by gradually accustoming people to Orwellian surveillance, by corrupting the very essence of what makes a society a free society and one worth fighting for.

And, as if that weren't enough, we're talking about global regulation, a cartel of parasites who, to cap it all, think they're doing the right thing when in fact they're sucking the lifeblood out of civilizations.

Here, ladies and gentlemen, are the AML and KYC regulations, an example of what not to do when you want to bring value to mankind via regulations, especially global ones, because you haven't taken the time - or wanted to - to measure the concrete results of the bloody useless actions you've made compulsory and which piss everyone off.

And I'm far from the only one to have noticed this: it's hardly ever discussed in the media, but one of the major motivations of those who develop and use cryptos is precisely to short-circuit this whole iniquitous and stupid system.

Fuel for cryptos

So you'll often see people in crypto circles talking about "permissionless systems", as opposed to KYC/AML, which requires you to obtain authorization from financial intermediaries to open accounts and use your own money: with Bitcoin, Ethereum, and many other crytocurrencies, anyone can create a wallet with a few clicks on their computer or smartphone, and send money all over the world, and nothing and no one can stop anyone from doing so, even to send the equivalent of $1 billion to "risky countries" like Pakistan, unless they physically go and threaten you, which is much harder than pressing a button to block or freeze all your funds…

And the person trying to stop you must be aware of your actions.

So not only do these cumbersome, stupid and ridiculous regulations have all the drawbacks already mentioned, but they are also a huge fuel that is stoking the fire of the significant cryptocurrency adoption we've seen in the 2010s through to today... and most of the KYC and AML players are completely blind to this!

As you can see, I'm quite upset, and yes, I'm definitely upset, because I think that at this stage, we can clearly say that such cumbersome and useless procedures, what's more implemented on a global level, are clearly a sign that the system has seized up, that it has reached a level of parasitism that is a form of corruption, very similar to what the Catholic Church was around 1500.

A note on the subject of this blog

We see here a major tendency for nation-states to try to curb the major disruptive effects of globalization and the Internet on them: setting up global regulations, forcing uncooperative players to show a little more enthusiasm, often with threats of sanctions.

And, as we see here, and as we had seen with FATCA, these regulations are often cumbersome, extremely costly for administrations and society, and incredibly ineffective.

They have two major results:

Creating immense friction in society, which diminishes its freedoms and wealth, which can, if allowed to continue in its current momentum, create real stagnation, in a similar way to what communism was able to do (though probably in a more limited way, admittedly).

Diminish the legitimacy of nation-states for those who take the time to analyze the actual results of these regulations, which motivates these people to build alternative solutions that can be highly disruptive to nation-states. This is exactly what is happening with cryptos.

I'll come back to these two major trends (the stifling of freedoms that leads to stagnation, and the loss of legitimacy that fuels the fire of disruption) in other articles on this blog.

What can we do ?

But don't forget the quote at the beginning of this section: it's not by asking the tens of thousands of people who earn their living (often very comfortably) by implementing these regulations that you'll get a pertinent critique of the problem, just as it was pointless to ask the vast majority of the clergy of the Catholic Church what the problem was with their institutions.

Still, if you happen to be one of these people, and you're aware of the problem, take your courage in both hands and stop participating in this iniquitous system! Read this scientific article to fully understand the ins and outs of the problem, then try to change the system from the inside, or be a whistle-blower, or resign, seize this chance to be a beacon of integrity in a corrupt institution, and try to bring real value to the world instead.

And if you work in a bank that is subject to these regulations, whatever your hierarchical level, try something too: raise your colleagues' level of awareness by sharing this passage with them, and the scientific article shared above, ask questions about the protection against discrimination that the KYC/AML department is doing, fight to prevent account closures if you can, challenge the people in the department by asking them what concrete impact their actions have on crime, etc.

And if you're in a political sphere that allows you to influence these regulations, simply ask to see their concrete results, and act (intelligently) accordingly.

And for all you freedom-loving people out there: don't miss an opportunity to criticize these regulations and point out their immense weaknesses.

The universe and humanity will thank you.

Follow Disruptive Horizons on Twitter to discuss blog topics, and be notified when a new post is published

"Nigel Farage says he may have to leave UK after bank closes his accounts", Tony Diver, The Telegraph, 2023

"After my banking travails, I fear Britain is lost", Nigel Farage, The Telegraph, 2023

"Banks told to uphold free speech after blacklisting customers holding certain views", Simon Foy, The Telegraph, 2023

“City minister summons UK bank bosses to discuss Farage account closure”, Aubrey Allegretti, The Guardian, 2023

"Understanding Policy Fiascoes", Mark Bovens , Paul 't Hart, 1997

"How Effective Are Suspicious Transaction Reporting Systems?", Chaikin, D. 2009.

"Just How Effective Is Money Laundering Legislation?", Harvey, J. 2008.

"Uncomfortable Truths? ML = BS and AML = BS", Pol, R. F. 2018b.

"Transnational Organised Crime, Laundering and the Congregation of the Gullible.", Van Duyne, P. C. 2011.

"Great Expectations but Little Evidence: Policing Money Laundering.", Verhage, A. 2017.

The core of these conclusions of this article comes from a research paper synthesizing numerous research studies, "Anti-money laundering: The world's least effective policy experiment? Together, we can fix it", Ronald F. Pol, 2020

"From Illegal Markets to Legitimate Businesses: The Portfolio of Organised Crime in Europe", Savona, E. U., and M. Riccardi. 2015.

See footnote 9

See footnote 14

Ditto

Ditto

Ditto

"Banks Are Closing Customer Accounts, With Little Explanation", New-York Times, 2023

"ING : un client interdit bancaire après la fermeture surprise de son compte", Capital, Noah Sdiri, 2022

"Banque N26 Comment réagir aux fermetures abusives de comptes", Que Choisir, 2022

"Comptes bancaires bloqués en France : des Russes déposent une plainte", Le Point, 2022

"HSBC among Hong Kong banks that close accounts tied to opposition group, members say", Jess Ma, South China Morning Post, 2023

"The True Cost of Anti-Money Laundering Compliance", LexisNexis, 2017

According to World Bank data

"Are KYC and AML still fit for purpose?", Liz Lumley, The Banker, 2022

See footnote 14

UN World Drug Report, published annually since 1997

Ditto

"Monitoring the Future, National Survey Results on Drug Use, 1975-2020", University of Michigan

Global Burden of Disease, The Lancet, 2019

“The Investigators - The Outlandish Inside Story of the Investigation That Created the Multi-Billion Dollar AML Compliance Industry”, David Caruso, 2023

Signed in Paris in 1948 by 58 member states

"Banks Are Closing Customer Accounts, With Little Explanation", New-York Times, 2023

"JPMorgan Chase Hacking Affects 76 Million Households", Jessica Silver-Greenberg, The New-York Times, 2014

"Equifax failed to patch security vulnerability in March: former CEO", David Shepardson, Reuters, 2017

KYC and AML are inverted justice. Assumed guilt, implement punishment (account freeze) and you have to prove innocence. There are signs of an evil system and intent. The goal is control and censorship, not crime control.

Is "all you freedom-loving people out there" a shibboleth?